One of the glorious piles of foolishness you will see again in Monday’s provincial throne speech is the idea that no provincial or federal government before this current provincial one paid any attention to public sector capital spending.

For too many years, for want of proper infrastructure, our province languished while other regions of the country prospered.

It’s foolishness because every government delivered capital spending, even in the leanest of times.

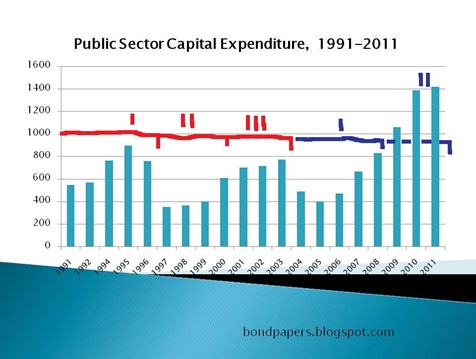

Take a look at this table. It shows public sector capital spending in the province from 1991 to 2011. That’s federal and provincial spending combined and it includes construction as well as equipment. The figures are compiled by the Statistics division of the provincial finance department using Statistics Canada figures.

The section marked Red I basically reflects provincial spending during the early 1990s recession combined with what appears to be any federal money that went into Hibernia. That would account for the peak in 1995 and the drop off in the last year of the project before the GBS tow-out and first oil in 1997.

Blue II represents the combined federal and provincial Conservatives’ “stimulus” spending.

Red III is a bit of an anomaly but since it covers both a federal and provincial election period, odds are good that there is a connection. Anyone who can offer a reasonable explanation is welcome to chime in on that one.

What’s curious is that the first three years of the current provincial Conservative administration is roughly the same as that Red II period in terms of total capital spending. It’s not because the provincial government was flat broke; it wasn’t.

To the contrary, the provincial government had cash and announced a fair dollop of spending in the run-up to the 2007 election. What seems to be reflected in this diagram is that a great deal of the capital works announced by the provincial Tories around the 2007 election just didn’t happen until two to four years later.

It’s one of those curious things but the current crowd what is ruling over us seem to have a chronic problem delivering their capital works projects. They can announce them alright, but finishing the delivery seems to be a problem.

Oh.

And there is no coincidence that capex is peaking in 2011, a definite provincial and likely federal election year.

- srbp -