Without new oil and gas discoveries, the Newfoundland and Labrador petroleum industry will dry up within a couple of decades. There hasn’t been a significant discovery in the offshore since the 1980s, with the exception of one find in the Orphan Basin.

The problem isn’t a lack of oil or gas. The geological estimates back up the notion there is plenty more to find. The problem is no one is looking for it hard enough to find it.

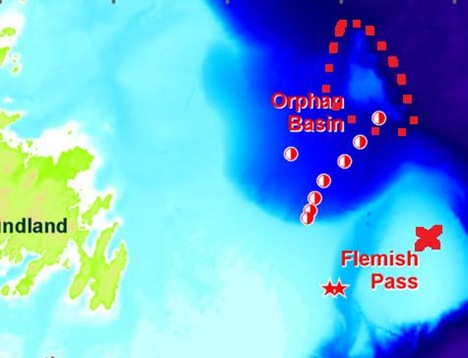

To give you a sense of how low exploration levels are now compared to a couple of decades ago, take a look at this slide. It’s taken from Wade Locke’s recent presentation for the Harris Centre.

Low exploration levels is one of the most important problems facing the oil and gas industry. It’s not a new problem. It’s not the only problem. There are others, all of which centre on the basic challenge of how we can make the most of our oil and gas resources now and in the future.

Here are some basic ideas that can help us to get there.

For starters, Newfoundland and Labrador has to be an attractive place for investment, exploration and development. Oil and gas is a highly competitive industry, especially in the exploration sector. There are only so many exploration dollars to go around. There are only so many rigs to go around and there are plenty of places in the world where companies can find oil and gas, develop it, get it to market and make a lot of money.

Sending delegation after delegation to oil shows in places like Houston doesn’t produce a single new exploration well. What the local oil and gas industry needs is a stable, predictable environment. That is something they haven’t had for a while.

One of the easiest things for the provincial government to do is set an offshore oil royalty regime and a gas royalty regime. The provincial government had an oil royalty regime but the 2007 energy “plan” to replace it with something else. Not surprisingly for the current administration, there is no sign of a new oil royalty regime four years after they promised it.

Ditto a natural gas royalty regime. The current administration promised one in 2007 but they still haven’t delivered. In fact, the provincial government has been working on development of a gas royalty regime for the past 14 years and still they haven’t managed to produce anything but a discussion that went nowhere.

With the royalty regime set, there’s no need for the provincial government to hold up any developments while it “negotiates” with a developer. That’s the sort of thing one might expect in a banana republic. It isn’t what happens in mature economies.

In the same way, the provincial government should set – or allow the offshore regulatory board to set – basic rules for local benefits.

The current administration held up the Hebron development and in the end settled for a royalty regime only marginally better than the generic regime. But any gains on so-called super royalties were offset by give-aways on the front end of the royalty structure and on local benefits in the form of research and development spending commitments.

Standard royalty and benefits regimes that work across a variety of price ranges and that work fairly for the resource owner - i.e. taxpayers - and the developer will promote stable economic development.

The provincial and federal government should also implement a policy of merit-based appointments to the offshore regulatory board. The Canada-Newfoundland and Labrador Offshore Regulatory Board is one of the most important agencies in the province. The most recent fiasco with efforts to stuff a former political staffer into a job she was unqualified for highlight the potential damage that politicians can do to an important official body. At the very least, the provincial government should advertise for applicants for board appointments based on well publicized criteria. Board appointees should serve for fixed terms and each appointment should come with a publicly available expiry date. The offshore board is no place for political hacks and cronies.

While the offshore oil and gas industry is well developed, the oil and gas industry that lies exclusively within provincial jurisdiction is not. As a way of encouraging development of a well-managed industry within the borders of the province, the Government of Newfoundland and Labrador should develop a regulatory board to administer lands, manage reservoirs, serve as a repository for information on oil and gas and generally serve as the focus of industry regulation from the three mile limit inward.

The new oil and gas regulator should complement the work of the offshore board. Naturally, the new board will assume some of the roles assigned to the old provincial petroleum directorate as well as ones that have grown up within the oil and gas division of the natural resources department. The new onshore regulatory board should also administer new, standard royalty and benefit regimes for any future developments.

Other elements of the 15 ideas (and more) also will apply to the oil industry. For example, breaking up the energy company and either privatizing it or forcing it to function like other companies would break its strangle-hold on the local business environment. This would inevitably allow for new life and energy in a sector that is rapidly becoming stagnant.

Without new life in the province’s energy industry, the future looks bleak. Staying on the current path is not a practical option.

These are a few ideas to stimulate life and growth and to create a future for the province and its people that works.

- srbp -