It's all fun because no one lost an eye.

And it's also funny to see someone else make a crack about your humble e-scribbler and a local posse.

Well, you don't have to ride a horse to recognize the stuff that comes out of the back end of one.

Take, for example, this comment from another corner of cyberspace:

However the federal government still reaped the main share of revenues from provincial resource developments through a combination of federal tax increases and equalization savings. As well for a couple of years the feds lifted the equalization ceiling (2000-2002). The introduction of equalization protection mechanisms acknowledge the issue but it did not address the fact that more had to be done to ensure equitable sharing of our resources. Notwithstanding this, the Province did not recieve [sic] the full benefit of the government revenue from these offshore resources as equalization offsets resulted in the lionshare [sic] of the fiscal benefits going to Ottawa. That did not change from 1990 to 2005 and the campaign for fairness failed as well. [Emphasis added.]Let's tackle the nonsense in order.

First there's the claim that the "main share" of revenues, from oil development incidentally, supposedly go to the Government of Canada. Related to that is the idea that the "lionshare" of fiscal benefits go there as well.

To find the facts, one need look no further than Wade Locke's assessment of net cash flows accruing from offshore development.

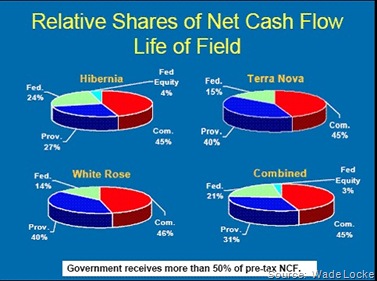

To find the facts, one need look no further than Wade Locke's assessment of net cash flows accruing from offshore development. The slide at right came from Locke's public presentation about a year ago on what constituted a "fair share" for the provincial government of offshore cash.

Take a hard look.

Of all cash flows, the federal government takes the smallest in each case, except Hibernia. In that case, it is only 1% above the provincial share and then only by virtue of the 8.5% invested to keep the project alive in the first place.

As a share of government cash flows, the provincial government takes 72% of Terra Nova flows and 73% of White Rose flows. That doesn't include any revenues from the White Rose extensions. In Hibernia, and leaving out the federal equity stake's 4% of cash flows, the provincial government takes 53% of government's share.

By no measure is the the federal share the "main share" or the "lion's share."

Second, let's take the comment about "the full benefit" of the government revenue.

That is a reference to the idea that by gaining more of its own revenues, a provincial government loses money under the Equalization top up scheme. Of course, that is exactly the way Equalization works. Gaining more own-source revenues is exactly what Clyde Wells was referring to in a 1990 interview with the Sunday Express:

By doing this, and by having equalization cut this way, we are coming closer to looking after our own needs and we are coming closer to recovering some of the dignity and self-respect you lose when you depend on the federal government for 47 percent of the revenue [in the provincial budget].

I can't wait to see the day when we don't get a dollar.The problem in 1990 was that the best estimates of experts was that the offset formula contained in the 1985 Accord, coupled with the Hibernia project's royalty regime and the price of oil at the time wouldn't produce any improvement in the provincial government's overall financial position.

In two Sunday Express stories in the fall of 1990, both Wells and then energy minister Rex Gibbons referred to a net gain in provincial revenues of only 30%, as Equalization payments declined. That was at a time when the economy was otherwise in severe recession and the provincial debt and the economic output were the same number.

The analysis used by Wells and Gibbons wasn't the bleakest, either. Wade Locke's assessment at the time was that the net gain to the provincial treasury was a mere three cents of each dollar.

We need to compare those assessments made before first oil with the actual experience. In practice, the situation was substantively different. Far from merely staying in the same financial place, the provincial government today is bordering on being a so-called "have" province for the first time since 1949 solely due to the revenues flowing from offshore oil projects due to the provincial royalty regimes.

The facts are uncomfortable, but only for those who insist on making arguments that simply ignore the facts altogether.

NSDQ.

-srbp-