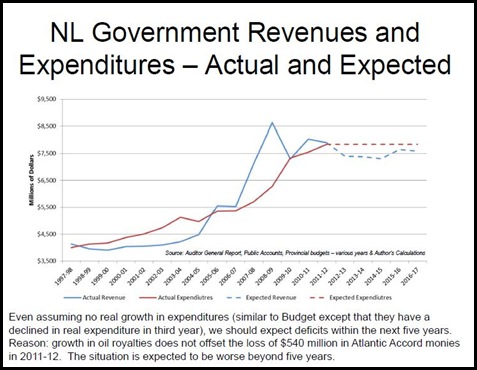

Take a look at this picture.

It comes from Wade Locke’s presentation at a conference of the province’s credit unions in Gander in the latter part of May.

The blue line is government income (revenue). The red line is government spending (expenditure).

When the blue lie is above the red line, you have a surplus. When the red line is above the blue line you have a deficit. The distance between the blue and the red line is the size of the surplus or deficit in any given year.

Let’s zoom in on the last bit there because it shows a period where government spending is going to outstrip income in every single year. yes, despite being a have province and pulling in billions in oil money every year, the current administration is forecast to rack up the public debt by plain, old-fashioned overspending.

Now there are a couple of things to note here.

First of all, Locke is allowing for constant spending. As he notes in the text under the slide, it is actually different from the provincial government version that claims a drop in spending three years out.

Given that the current budget shows a sizeable increase in spending you can safely forecast a five percent increase in annual government spending in every single one of those years. That’s actually much less than what the Tories have done since 2003 but let’s be - no pun intended – conservative in our forecast of their overspending.

Second of all, let’s look at Locke’s explanation for this problem: “growth in oil royalties does not offset loss of $540 million in Atlantic Accord monies in 2011-2012”

There are two words for this: pure crap. In more polite terms, this is where Locke’s economics proves woefully unable to contend with a fundamental problem in government policy. His comments, as a result, are simplistic in the extreme and – at the very best – misleading.

What you have here – in simplest terms – is a government that has no control whatsoever over public spending. The reason spending outstrips income is because the provincial government lacks a policy that would allow it to establish spending priorities and to stick with them.

What’s more, those big blue spikes there in the middle and the surpluses they represent are purely accidental. The only reason they exist is because the money flooded in so fast that the finance ministry ran out of places to spend the money during the year.

Sound fiscal management – spending public money wisely – is the most fundamental responsibility that a responsible government has. If a government doesn’t control spending it can wind up, in the extreme, in the situation newfoundland found itself in the early 1930s.

All Locke does here is offer an excuse by trying to shift responsibility from the government responsible for the mess to one that isn’t. What’s more, even if the federal government agreed to continue sending $500 million annually to St. John’s any provincial government that cannot control public spending will always be running up deficits.

What is truly chilling in this slide is that last bit. It ends in 2017, the same year the current administration forecasts it will have finished building the multi-billion dollar Muskrat Falls project.

Locke has a good chart of the debt over the next six years. What you have to realise is that he is basing it, apparently, just on the growing deficits on annual spending. Locke rightly notes that any changes in spending or in oil prices will make the deficit in any one year bigger or smaller than he has shown it.

If you can’t pick out the numbers there, the last one is $10.5 billion. That’s the same number it was in 2003 when the provincial Conservatives took power. And as Locke notes, things don;t get better after that point.

Things also aren’t really going to be as rosy as those numbers might appear to some. Locke left out – apparently – the debt resulting from the Muskrat Falls project.

Conservatively, you can add another $5.0 billion to that figure. That’s because the $6.0 billion the Dunderdale crowd say that Muskrat will cost is laughably low. It will likely wind up costing closer to $10 billion than not. Even if they can somehow use cash reserves or other money to keep the borrowing down, the provincial government and Nalcor won’t be able to avoid borrowing about half of the total cost of the project.

And if all that doesn’t leave you cold, just remember that Wade Locke usually makes comments that pout the current provincial administration in the best light possible. The fact he delivered a talk recently that suggests there are serious problems is a sign things are nowhere near as rosy as some would have you believe.

There are problems ahead.

Serious problems.

The current administration helped create the problems.

They have no intention, let alone a plan, to deal with the problems.

That is Dundernomics at work.

- srbp -