The province’s public utilities board is concerned about the impact Nalcor’s capital works programs will have on consumer rates even without taking Muskrat Falls into account or considering any increase due to fuel costs for thermal generation.

The comments are in the board’s approval, issued January 24, for Phase I of Newfoundland and Labrador Hydro’s capital works application for 2012. Hydro is a Nalcor subsidiary.

On page 10 of its order the board expressed concern “about the impacts of the proposed and forecast level of Hydro’s capital spending on customers.”. The board said that “this level of spending raises concerns as to whether this approach is sustainable given the significant impact on revenue requirement.”

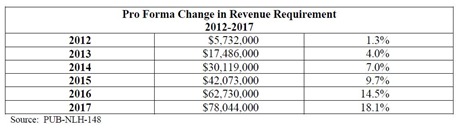

Newfoundland and Labrador Hydro showed the percentage change in revenue requirement “as a result of the five-year projected capital spending”, a table the board reproduced on page 10 of the Phase I order:

The board then notes that even allowing for offsetting some of the costs through depreciation, “the impacts of the projected capital spending are significant.”

The board also noted that “these increases do not reflect increases in operational costs which may be expected in the normal course.” That’s code for the cost of oil used to generate electricity at Holyrood for three months of the year.

One of the main arguments in favour of Muskrat Falls has been steady increases in electricity rates due to rising fuel prices. Natural resources minister Jerome Kennedy, for example, claims that electricity prices in the province will increase due to fuel costs and that Muskrat Falls will cost consumers less than if they stuck with oil.

However, neither Kennedy nor Nalcor have apparently included any of the costs for the proposed capital works program into their imaginary rate calculations they developed in late 201o and are still using today. In its 2012 order, the board noted that it “is concerned that the significant increases in proposed and projected capital expenditures in 2012 and subsequent years were not forecasted by Hydro as recently as one year ago.” [italics added]

This new information suggests that any increases from Muskrat Falls would be on top of significant increases that neither Nalcor or the provincial government have forecast.

Apparently not included in the Phase I order was more than $200 million in capital spending Nalcor wants to spend to upgrade the interconnection across the isthmus of Avalon. The board separated that project out since it was a last minute addition by Nalcor. It is now considered as Phase III of the 2012 capex application.

SRBP readers will recall that this upgraded line could actually delay the need for a Holyrood replacement. The provincial government’s current plan is to replace Holyrood with Muskrat Falls and later add more oil- fired generation than the island system currently has at Holyrood.

- srbp -