The Premier’s communications - Glenda Power - sent a couple of twitter messages to CBC’s Curtis Rumboldt on Friday. She was apparently correcting him on the impact closing Corner Brook Pulp and Paper Limited would have on the Muskrat Falls project.

Simply put, that’s not true.

SRBP has discussed how people can make bad decisions even with the best of intentions. In this case, Power is showing a variation of the old problem of selective perception: you see what you want to see.

What Power is referring to in that tweet on the bottom (the first one she sent) is a section of the report that looks at what we’ll call the cost comparison between Muskrat Falls and the only other option the public utilities board was allowed to look at. The “sensitivity analysis” looked at what might happen if you changed the load forecast, the cost of the projects and several other variables.

To really understand the issues involved you have to look at the whole report, especially the detailed studies that make up Volume 2.

In the section on how much electricity the island may need in the future, MHI said this (page 22-23):

The principal risk in the forecast is the long term viability of the pulp and paper mill. If the Corner Brook mill closes, there will be a large gap created between excess supply and demand.

MHI then offers this comment:

In the long term, this gap will diminish as new industrial loads potentially locate on the island throughout the forecast horizon. The original load forecast covers a twenty year period and is extended out to 2067. Unforeseen events can and likely will happen during the forecast period and beyond

What are those new industrial loads? MHI doesn’t say. They wouldn’t dare say because those “unforeseen events” can change things dramatically. MHI discusses that because over the past decade the major change in industrial electricity demand on the island has been the closure of the two Abitibi mills in the province.

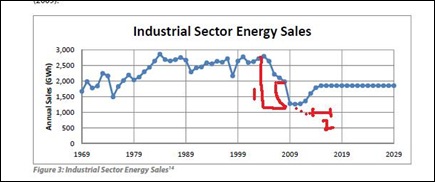

This chart is taken from Volume 2 of the MHI report. In that bit SRBP marked (red “1”), you can see the total drop in sales starting in 2004 or so. The long drop – marked by what looks like a backwards “7” – looks like that came after AbitibiBowater closed the Grand Falls mill. Altogether, MHI reports that the drop was an average of 152 gigawatt hours per year.

The blue line climbs back up again around 2013 as the Vale smelter comes online.

Now Corner Brook Pulp and Paper is the largest industrial electricity user on the island at the moment, according to MHI. Close it down and add Vale and you would see a net loss of electricity sales. SRBP is going to ballpark that new level where the red “2” is. It might be marginally higher, like maybe the 2009 level.

But make no mistake: if you drop CBPPL from the island load, there will roughly half the industrial electricity demand on the island that there was in 1985 or even in 2003.

MHI talked about how the “gap” between supply and demand will supposed diminish over the forecast period. But frankly, they then noted that the forecast period takes you out to 2067. All sorts of things can happen by then. MHI just took an interpretation that was optimistic for the provincial economy.

Their table, reproduced here, doesn’t show any of that optimism. It shows industrial sales running as a constant right through the end of their chart. That is, incidentally, 37 years before the end of the forecast period. However, they don’t forecast any increase at all, so the industrial sales for 2067 according to MHI should be what it is with Vale. Here it is in plain English, from Volume 2, page 24:

In the longer term, the industrial forecast runs the risk of being too low because no new industrial loads are forecast for the entire review period to 2067.

Where MHI got the idea that the “gap” will close is anyone’s guess, but when you read their whole report they don’t show any sign of it.

Ah yes, you may be saying but Power talked about a “sensitivity analysis” and that is something else. Let’s take a look at what the MHI reports says at Volume 2, page 206:

Additional sensitivities were performed by varying multiple inputs. For example, if there is a 20% decrease in fuel costs, combined with a 20% decrease in the annual percentage load growth post 2014, and a 20% increase in the capital cost estimate for both Muskrat Falls Generating Station and the Labrador-Island Link HVdc system, the CPW differential would be reduced to $159 million in favour of the Infeed Option.

Those aren’t outrageous shifts in either of those three factors. Look at the result. The $2.2 billion advantage for the Muskrat option in the government’s set-up becomes a mere $159 million spread out from now until 2067.

Don’t run past that too quickly. Do the math: $159 million divided by 55 years. It works out to $2.89 million per year.

That’s pretty much frig-all in the world of multi-billion projects.

But it gets better:

Also, should the existing pulp and paper mill cease operations, and its generation capacity be available for use on the system (approximately 880 GWh), and should the capital costs of both the Muskrat Falls Generating Station and Labrador-Island Link HVdc projects increase by 10%, the CPW for the two Options would be approximately equal.

Take CBPPL out and raise capital costs by a mere 10%. That cost increase would be likely these days in any event. But when you remember that MHI was working with cost estimates that were somewhat rough, a 10% increase in the cost estimate is virtually guaranteed.

Now you can take CBPPL out of the picture. Let’s hope the mill stays open but events of the past few days make the mill closure is a bit more thinkable than it was a few months ago.

Now look - again - at what the Premier’s communications director tweeted:

MF still least cost option.

Ummm.

No.

Selective perception can lead you astray. When you display your selective perception in public, it just becomes that much harder to persuade people you are right.

After all, you can’t be right, when you are obviously wrong.

-srbp-