JM’s 175 pager delivered to the Public Utilities Board in February has a great deal in it that amplifies the points Weil touched on. You can find a collection of the relevant slides here: JM – Demand and Prices

SRBP was wrong in stating that no one had mentioned the impact of export sales on the rate paid by domestic customers in Newfoundland and Labrador. JM did it in his lengthy study and illustrated the point quite forcefully.

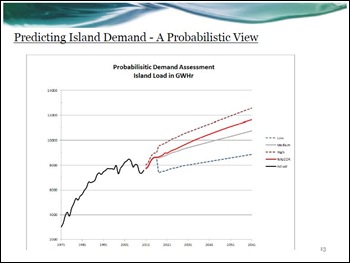

Pay attention to the placement of the Nalcor forecast as being somewhat on the optimistic side.

The scenarios are based on finance department populations with some extra considerations thrown in.

Slide 12 shows the assumptions. The low demand scenario has the Corner Brook mill shutting down. The high demand scenario includes one new mine and Corner Brook staying online.

Before you get all excited about those aspects note that Nalcor’s assessments are optimistic. Kathy Dunderdale likes to pretend that Manitoba Hydro International thought Nalcor’s forecast was too low. That’s not what they said. MHI argued that Nalcor’s approach to forecasting was so flawed that they could wildly underestimating demand just as in the past they had wildly over-estimated demand.

To get a sense of that past record, look at JM’s Slide 14. It gives a sense of how Nalcor forecasts have been known to be quite optimistic.

The huge line that climbs to the from the left in the picture is what Newfoundland and Labrador Hydro forecast in 1979 as island demand.

Slide 20 is the estimate of the resulting cost (dollars per megawatt hour) under the proposed power purchase agreement (PPA) between Newfoundland and Labrador Hydro and Nalcor. This is the estimate if exports were not used to lower rates.

At the time JM did this assessment, the estimated cost of Muskrat Falls electricity was $230 per MWh in 2017 for energy delivered. The going rate for export was in the $40-60 per MWh range without any transmission costs.

Look at the bottom lines. Those are ones you get in Nalcor’s scenario where demand is high. In the low demand scenarios without export and you get those phenomenally high costs to consumers. That’s the sort of thing Weil was driving at.

As Slide 28 notes, Nalcor wouldn’t answer the question.

For all the information that we do have from Nalcor and the provincial government, there’s still a lot that they haven’t disclosed.