The number is a hard one to wrap your mind around.

$15.6 billion.

That’s the amount of oil royalties and mining royalties the provincial government collected from 2005 to 2012.

Once you think you have that figure in your mind and understand what it means, think about this: with the exception of about $1.4 billion, the money is apparently gone.

Spent.

Never to come again.

If you want to understand how the provincial government got itself into the mess, just think about all that money. Newfoundland and Labrador is a “have” province with a government that is laying people off and cutting programs. Then realize that for all that cutting the government is still planning to spend upwards of a half a billion dollars a year more than it is taking in.

The idea is staggering.

Well, be prepared to be floored completely.

Over the next series of posts, SRBP will lay out another approach the provincial government could have taken to handling our oil and mining income.

It involves a set of simple policies that take into account some key factors about oil and mineral royalties.

First, we know that the money from these commodities only comes once. They are non-renewable resources, a fact the provincial government understood in the Equalization negotiations almost a decade ago.

With that in mind, we need to find a way of maximising the benefit from this one-time cash. Paying down debt and building infrastructure are two ways of producing a lasting benefit from one-time cash.

Paying down debt – actually clearing it off the books – frees up money that can be spent on other things. Building infrastructure like roads, schools and hospitals is also a way of getting long-term benefit from natural resource revenues.

A third way is to create an investment fund of the kind Norway and Alberta started decades ago. These income funds would invest oil and mining money and generate income much like any other pool of investment cash. The money earned each year could be used to increase the fund or drawn down to fund current year spending.

What we are talking about here are ideas summarized in a post from 2011 called “Strengthening the Treasury”.

Second, we know that the income from exploiting these commodities is volatile. It goes up and down in a way that is unpredictable. One of the ways to overcome that problem is to create a stabilization fund. Former finance deputy minister David Norris discussed this idea briefly in his paper for the Vic Young Royal Commission a decade ago.

At least three provinces (New Brunswick, Manitoba and Saskatchewan) have established Fiscal Stabilization Funds (FSF) which provide some recourse to manage the swings. Unexpected revenues or windfall gains are collected, reported and allocated to the FSF when they arise. Then, as required, the fund is drawn down to facilitate budgetary balance. The bottom line effect may be the same as the smoothing technique but, the

approach is clear and the reporting is more transparent. A reader of the financial results can clearly see the surplus or deficit, as well as the changes to the Stabilization Fund.

The balance of the Fund and the movement up or down in a given year is clearly reported, as is the fiscal position after any changes in the fund.Some other provinces employ variations of the budget smoothing practice. Manitoba used a mixture in its 2002 budget by drawing down its FSF as well as a special dividend from Manitoba Hydro. The Province of Quebec also drew down a $750 million reserve account to address its budgetary position in 2002. In its 2003 Budget, Alberta established a “Sustainability Fund” to smooth the effects of wide swings in resource revenues.

The SIDI Simulation

For the purposes of this post, we started applying a set of new policies in 2005 and ended in 2012. Those are the years for which we have accurate information. 2005 also marks the year immediately after the Conservatives started their initial commitment to sound financial management. That was also the year they last applied it.

The rules are simple. We’ve separated out oil and mining royalties from other provincial revenues. Until those royalties hit at least $500 million annually, we used the money to balance the current and capital spending at the levels set by the government at the time.

We put any surplus into a Stabilization Fund, one of four new funds created for the non-renewable resource money. The simulation is called SIDI after the initials of the four funds: Stabilisation, Infrastructure, Debt, and Investment.

The year that those non-renewable royalties exceeded $500 million we did the following:

- Current account spending is allowed to increase every year by four percent. That’s double the national rate of inflation.

- Capital expenditure is fixed at $500 million annually. Take a look at Norris’ paper. That number is roughly double the average capital budget for the 1990s.

- We allocated the total oil and mining royalties each year in equal allotments into four funds:

- The Stabilization Fund is used to cover any deficit between the annual spending, increased at four percent, and the non-renewable revenues coming to the provincial government. Just to be clear, non-renewable revenues includes any federal transfers but not the one-time cash from the January 2005 transfer deal.

- The Infrastructure Fund will be used to pay for the annual capital works budget of $500 million per year. In the simulation, we avoided using this fund if the Stabilization Fund could cover the annual spending. The Debt Fund and Stabilization Fund are to be used to cover annual spending under strict and limited conditions.

- The Debt Fund can be used to reduce debt by paying it off or by adding to the sinking funds, whichever produces the greatest financial benefit.

- The Investment Fund is intended to generate new income from investments according to defined rules.

- While this scenario didn’t include the figures in the calculations, any of the funds could be used to earn interest income. Obviously the Investment Fund is intended to do that. The Debt Fund could also be used that way and the Infrastructure Fund certainly could.

- The SIDI model doesn’t include any cash for Muskrat Falls or the oil equity stakes.

The Big Picture

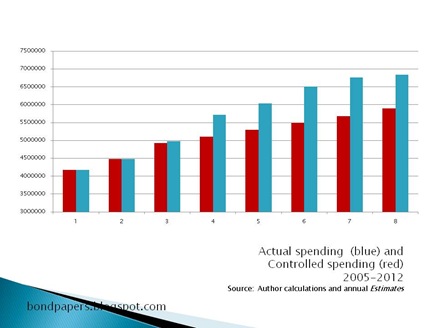

The chart compares the total annual spending for the SIDI model in red and for the actual government spending in blue.

Oil and mining royalties almost reached in $500 million in 2005 and 2006. SIDI doesn’t cut in until 2007, the year the royalties surpassed the trigger. Starting in 2007, the SIDI model limited annual growth to four percent per year. The result is that spending increased from about $4.1 billion to $5.9 billion for the SIDI model for the time period. That compares to to $6.8 billion actually spent.

While SRBP will get into the detailed operation of the model over the rest of the week, here are some highlights:

- The Stabilization Fund could handle the capital spending and annual increases until 2011.

- At that point, one simulation forced use of the $500 million drawdown from the Infrastructure Fund in 2011 and 2012.

- Between 2005 and 2012, the SIDI model allowed for the funding of the four percent annual increases plus a cumulative total of $3.4 billion in capital spending.

- At the end of 2012, the Infrastructure Fund stood at $2.675 billion*, not including any interest

- At the end of 2012, the Investment Fund stood at $3.6 billion, not including any earned interest. The Debt Fund was the same size.

In Wednesday’s post, we’ll look at the annual spending increases and how the Stabilization Fund and Infrastructure Funds work in the SIDI.

-srbp-

* Corrected from $3.36 billion in original.