Cost estimates for the Muskrat Falls project have apparently jumped by 16% - $1.0 billion - in the past year. That’s based on information released by the provincial government on Tuesday and the details of the federal loan guarantee.

The new price appears to be $7.2 billion. The Decision Gate 3 estimate, released in October 2012, was $6.2 billion for the Muskrat Falls dam, a tie to Churchill Falls, and the line to Soldier’s Pond on the island of Newfoundland.

The new cost is 44% more than the $5.0 billion cost estimate for the dam and island link components of the project when it was approved in late 2010.

Finance minister lowballs equity

NTV’s Mike Connors reported on Wednesday night two contradictory statements coming from the provincial government. Reporters asked Premier Kathy Dunderdale on Tuesday about the amount of equity required. Dunderdale wouldn’t give a number. On Wednesday, finance minister Tom Marshall told Connors the provincial equity share would likely be $1.9 billion.

But that doesn’t look to be accurate.

Mike Connors tweeted on Tuesday how the provincial government plans to apply the $5.0 billion in borrowed money:

Loan covers 2.6 billion for Muskrat Falls and Labrador transmission assets, 2.4 billion for Labrador-Island Link

That breakdown stands out because in the federal loan guarantee documents, there are two different maximum debt/equity ratios corresponding to those two components of the project. The most Nalcor can borrow on the dam and Labrador transmission infrastructure is 65% of the final cost. On the Labrador-Island Link, they can borrow a maximum of 75% of the final cost.

It should be a fairly safe assumption that the provincial government would borrow what they needed, not more. They also wouldn’t borrow less than they needed because - among other things - then they’d have to go back and renegotiate another set of loans at different interest rates.

Here’s what that adds up to be if you do some simple math:

| Debt | Equity | Total (billions) | DG 3 (Oct ‘12) | DG 2 (Nov ‘10) | |

| Muskrat Falls | 2.6 | 1.4 | 4.0 | 3.4 | 2.9 |

| Lab-Island Link | 2.4 | 0.8 | 3.2 | 2.8 | 2.1 |

| Total | 5.0 | 2.2 | 7.2 | 6.2 | 5.0 |

Here’s how you figure out those numbers. If we know the maximum amount they can borrow for the component and we know how much of the total that is, then we can figure out the current total estimated cost for each component. We know that $2.6 billion is 65% of the total for the dam and link to Churchill Falls. Likewise we know that $2.4 billion is 75% of the LIL cost. A little bit of division and we get the totals. A wee bit of subtraction and you get the equity component.

As you can see, the equity share for $5.0 billion in borrowing using the federal loan guarantee figures works out to be $2.2 billion, $300 million more than Marshall’s number.

Higher Equity Consistent with Earlier Estimates

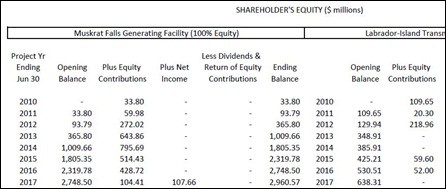

There’s another reason to believe that Marshall’s number is too low. The estimated $2.2 billion in equity at this point is close to the equity injections tabled at the public utilities board hearings by Nalcor. They forecast annual equity injections by the provincial government totalling almost $3.0 billion on a project estimated to cost less than the revised number in this post.

Now admittedly the assumptions in that case were somewhat different than the actual situation, but the actual situation isn’t finished yet. In fact, it’s barely begun.

If the provincial cabinet approved the project including a scenario based on higher equity injections than the project currently shows, they’d have to stand by the projections. After all, the overall cost of the project has jumped in the meantime.

What’s more, as project costs continue to climb even beyond the current estimate, the only place it seems Nalcor could go for cash to cover its rising costs would be the equity partner. In other words, as the costs rise, the provincial government will wind up footing the bill one way or another.

Decision Gate 4 Cost Max Three Years Early

Nalcor is using a decision gate process to manage the Muskrat Falls project. Having passed DG 3 in 2012, Nalcor will face its next decision gate at the end of the engineering, procurement, construction, and commissioning stage.

Cost estimates at each decision gate are not fixed. They come with an estimated variability. At DG 3, the $6.2 billion estimate for the dam and island link came with a potential variation of plus or minus 20% (AACEI Class 3 standard) as Nalcor stated in its final brief to the PUB.

While Nalcor will likely work to keep costs under control, the decision-making process allows the company to exceed its DG 3 estimate by up to 20% and still be considered within budget ranges. In other words, the estimated total project cost at the next decision gate could be around $7.5 billion.

Here’s how the SRBP revised project cost compares to Nalcor’s estimates. The figures in this table are taken from a document released by the Nalcor front group organized by former Nalcor board chair Cathy Bennett and others to lobby for the project.

| Muskrat Falls (billions) | Lab-Island Link | Total | |

| DG 2 (2010) | 2.90 | 2.10 | 5.00 |

| DG 3 (2012) | 3.40 | 2.80 | 6.20 |

| 2013 | 4.00 | 3.20 | 7.20 |

| DG 4 (2017) | 4.08 | 3.36 | 7.44 |

The Decision Gate 4 figure is shown as the maximum permissible variation from DG 3, that is, DG 3 + 20%. As you can see, the 2013 figures that derive from the loan guarantee information shows that the project estimates have already pushed within about $200 million of the DG 4 maximum. The end of the construction phase would be 2017.

In some posts, SRBP has mistakenly indicated the DG 3 figure had more variability, that is plus or minus 30% rather than plus or minus 20%. The AACEI Class 3 standard has a maximum high value of plus 20%.

In that SRBP mistake, the DG 4 number around $8.0 billion. At the rate the project is going, the SRBP mistake might wind up underestimating the final cost by another 20%.

-srbp-