The real political division in society is between authoritarians and libertarians.

16 June 2016

The Budget and the Economy #nlpoli

Finance minister Cathy Bennett says that's bollocks.

Let's see which is right.

12 August 2015

Sucks to be us #nlpoli

Not so very long ago, provincial Conservatives were crowing about how they would be running all sorts of mining projects in Labrador using electricity from Muskrat Falls.

These days, the word from Labrador isn’t all that good. One mine is closed and, on Tuesday, things looked bad both for the major mine operating in western Labrador and the KAMI project.

No one can take an glee in the bad news. What we should do is remember that the assumptions on which the Conservatives spent heavily over the past decade were completely inconsistent with about a century and a half of experience with resource extraction industries years in Newfoundland and Labrador.

Rather than learn from our considerable, collective experience, the Conservatives arrogantly assumed they alone knew better than everyone else.

They didn’t.

We all get to pay the price.

Oh joy.

-srbp-

19 November 2014

When the budget comes… #nlpoli

We’ve got a provincial government in Newfoundland and Labrador that has been budgeting for years to spend more than it brought in.

Way back in the beginning, way before the oil money cut in suddenly and largely unexpectedly, Loyola Sullivan said that people should expect the Conservatives to run deficits annually of half a billion dollars or more. The logical implication of what he’d said in 2005 was that it might have been 2014 until the Conservatives balanced the budget.

Now to be fair, Sullivan was speaking about the magnitude of the provincial government;s financial problem as he and his colleagues found it in 2004. But at the same time, by 2005, we were also talking about how the Conservatives intended to run things themselves.

They were clearly not as concerned about public debt as they had been in 2003. Part of that might have had something to do with this idea they had of making a killing selling cheap electricity into the United States, but frankly, Sullivan’s forecast of a debt of about $17 billion – which the Conservatives delivered on – suggests they really had something else in mind.

20 May 2014

Always read the large print #nlpoli

The Conference Board of Canada released a report last week that assessed economic performance in each of the provinces in Canada.

“The resource-driven economies of Alberta, Saskatchewan and Newfoundland and Labrador can boast A+ grades for their economic performance,” read the first sentence of the news release accompanying the report, titled How Canada Performs: Economy.

Amazing stuff and more than a few people - most likely provincial Conservatives – stuck their chest out in pride. They should have read the big print in the report. The first sentence is more than a wee bit misleading.

14 January 2013

Putting selective “facts” on the splitting table #nlpoli

Premier Kathy Dunderdale wants to have a “conversation” about the provincial government’s financial mess and the ways we might fix it. That’s what she told CBC’s David Cochrane in her year-end interview.

One of the things Kathy wants to talk about is taxes, specifically the number of people not paying the bulk of the taxes the provincial government collects.

Kathy doesn’t really want to have a conversation, of course. Kathy likes jargon. She uses jargon a lot. She thinks it makes her sound smart. It never has. Kathy uses jargon so much that It just makes her sound like someone trying to sound smart.

06 December 2012

Paying Attention to Details #nlpoli

Gabriella Sabau is an economics professor at Memorial University's Grenfell campus out in Corner Brook.

Sabau thinks Muskrat Falls is wonderful idea for three reasons.

For one thing, it’s green. For another thing, the electricity rates for consumers are supposedly low.

And for a third thing, "there will eventually be affordable power that will help attract business and investment."

Sabau noted the overall cost, though:

“The initial cost of the infrastructure is really high and those initial costs need to be paid up front,” she said.

Hmmm.

Paid up front.

And "eventually" the power will be affordable for consumers.

As it seems, Professor Sabau doesn't know much about Muskrat Falls. If she did, the economics professor would know that the project costs won't be paid up front. In fact, the project financing is deliberately set up to push the costs off to the distant future.

And it is consumers in the province who will be passing those costs later rather than sooner. “Eventually” will be a long time for consumers.

On the affordability thing, Sabau will evidently be quite happy. Business will find the power eminently affordable up front. Because consumers are paying all the costs plus profit, business and export customers get a gigantic deal right at the beginning.

"Eventually" comes quickly for them. In fact you could say that businesses and export customers will get the huge benefit immediately.

And those consumers for whom “eventually” really means eventually? Well, they won’t likely see profit from their considerable investment during the current century.

"Eventually" for the people paying the bills really will be "eventually" as in some undefined point in the far distant, almost incomprehensibly far away future.

You really have to love economists who pay attention before they offer opinions.

-srbp-

14 December 2011

A grain of salt #nlpoli

Around this time of year the country’s major banks issue their economic assessments of the current year and their forecasts of the coming one.

Royal Bank issued the most recent one. Not surprisingly, the bank’s economists are forecasting that the provinces that are most heavily dependent on natural resources will do quite well. Saskatchewan and Alberta will lead the country in economic growth, with Newfoundland and Labrador in fourth place.

RBC’s forecast for 2012 and 2013 has Newfoundland and Labrador in the same relative position. Natural resource prices and capital construction are driving things. Over the next couple of years, new mineral developments will offset declines in oil production, according to RBC. While their reasons may be slightly different, BMO and Scotiabank’s forecasts are all generally similar to RBC’s view.

There’s nothing surprising about any of that. Newfoundland and Labrador has enjoyed phenomenal economic growth for most of the last 15 years. In 2002, for example, the provincial gross domestic product grew 8.2% and in 1998 and 1999, the province led the country in economic growth for two years in a row.

There’s also nothing about the current economic growth that has anything to do with the party currently in power either. Some people would like you to believe otherwise. A great many people in the province believe otherwise. But they are wrong.

What you really need to do when looking at these economic projections is go beyond the short-term and the superficial.

Like oil prices. Current thinking is that oil should be $100 a barrel on average. In 2011, oil prices operated within a pretty narrow band, so if things stay like that, the world should be fine.

But…

The biggest, and more bullish, tail risk is of heightened turmoil in the Middle East and north Africa and, increasingly, in Russia, the world’s second-largest oil producer. An attack by Israel on Iran, for example, could push oil prices briefly towards $250 a barrel, according to some estimates.

Now with production in this province forecast to drop by 20-odd% from 2011, that might get a few people really excited. Russia could be Kathy Dunderdale’s best friend, someone quipped. Oil at $250 a barrel for any length of time would deliver a pretty sweet financial reward into the provincial treasury. Some people might even use it as an “I told ya” moment to justify Muskrat Falls.

Just consider the cost of living with oil at around $100 a barrel, as it is now. Look at the cost of living in all sorts of places, including Labrador West where housing prices are already at crisis levels for a great many families.

Now think of what it would be like with prices driven up by the costs of shipping just about all major consumer goods into the province.

Not pretty, eh?

And for those people who imagine the Americans desperate for cheap hydroelectricity at that point, well, the picture is even less rosy for them.

ExxonMobil produced an interesting energy forecast recently that looks at what the energy world might look like out to about 2040. Electricity demand will grow globally. But in the United States, expect to see more electricity produced by natural gas. There’s plenty of it and new natural gas plants are much more efficient at producing electricity than existing methods.

As for price, well, take a gander at this forecast of the cost of producing electricity in 2030:

Electricity produced from natural gas will be less than half the cost of Muskrat Falls electricity.

Forget about those export sales, gang.

But just imagine carrying the huge debt from Muskrat Falls, paying the electricity prices in this province because the provincial government forced you to pay for it and trying to cope with all the other increased costs coming because oil is more than double what it is today.

You really need to take all this talk of wonder and glory with just a grain of salt. Things are good these days, better than they have ever been. But if we make mistakes today, if we don’t look at the big picture, we can be paying for them tomorrow.

Big time.

- srbp -

15 November 2011

Economy to slow down? #nlpoli

The Canadian economy will slow in the months ahead, according to the Organization for Economic Co-operation and Development (OECD). As the Canadian Press reported:

Severe debt problems in Europe combined with slow growth in the United States, Canada’s biggest trading partner, to drop demand for the natural resources Canadian companies produce.

- srbp -

09 October 2011

The Folly of Linear Thinking #nlpoli

New Brunswick’s David Campbell has an interesting post about the folly of believing that things go in straight lines.

Like say, oil prices have been going up for a while now and will only go up in the future.

And therefore a hugely expensive electricity project makes sense because oil surely will always cost way more than it does now on a go forward basis.

Really it’s just a variation on part of the logic behind the 1969 Churchill Falls contract and the lack of an escalator clause. If you can’t imagine the price of something going in one direction, you’ll bet on things going the other way.

It’s the same as assuming that oil prices will always be higher than a certain amount – say US$50 - and pegging extra cash to that number.

There are lots of examples of linear thinking out there: assume the future will look like today.

And it’s usually the best way to make a gigantic mistake.

- srbp -

23 June 2011

Experts warn of external threats to recovery

Along with population statistics, here’s another one you can bet the current provincial Conservative crowd won’t be holding out quite as enthusiastically as the fabricated version of Bank of Canada' governor’s remarks they were using until recently.

As the Globe reported:

Top policy makers indicated Wednesday that they are on heightened alert for a deeper crisis in Europe that spreads beyond Greece and, potentially, hurts Canadian banks or the wider economy. Though the direct exposure of Canadian banks to countries such as Greece is low, the Bank of Canada warned that Canada’s financial institutions are vulnerable through links to the United States and other countries that are much more exposed.

Those top policy makers include analysts at the Bank of Canada and federal finance minister Jim Flaherty.

The question that remains is what economic problems in the United States and Europe would do to demand for oil – our new chief export – and other commodities as well as what it might do to prices for them as well. Anything that drops the price and the demand will also drastically affect provincial government revenues.

That won’t be good on a go forward basis, to use another of a recently famous politician’s famous phrases. Since the provincial government doesn’t even have an imaginary protective bubble this time, that could make what one analyst forecasts as a bad deficit and debt situation get much worse.

- srbp -

16 June 2011

The looming debt problem: update

Canadian household debt is at at record levels according to report by the Certified General Accountants Association.

The latest report adds a new twist to a discussion of the potential risks for consumer debt in this province discussed in a post last week.

Table 17 from the report shows provinces with segments of the population considered to be highly vulnerable for debt growth and financial problems associated with heavy debt loads.

Another table (19 on page 74) shows levels of savings for Newfoundland and Labrador are relatively low. At the same time, house prices increased at the highest average level of all provinces for the period 2007 to 2009.

According to some thinking, the economic vulnerability represented by small savings could be offset by the relatively high level of equity that could be represented in the high house prices. That would theoretically make Newfoundland and Labrador no more risky than Alberta where the savings levels are the highest in the country while house prices have dropped lately.

Small problem.

House prices can shift dramatically while savings and investments tend to hold value over a long period of time.

The summary of that chapter’s conclusions also sounds a strong warning, even allowing that the conclusions are for the country as a whole, not just one province. Incidentally, this is all one paragraph in the report. The layout is changed here to make reading easier:

First, the positive signs of improving labour market conditions portrayed by the unemployment rate and the hiring intentions of firms may be deceptive. Labour market conditions continue to be fairly weak: the market’s ability to keep up with the increase in working age population recovers slowly (and even deteriorates in some of the provinces); the long-term unemployment rate continues to increase while the decline in the proportion of discouraged workers has not yet materialized. Weak labour market conditions may suppress the short-to-medium term growth in earnings while increased and more prolonged absence of employment may decrease individual’s life-long earnings.

Second, certain socio-economic groups (i.e. youth, workers with low educational attainment, lone parents, and self-employed) may be seen as vulnerable as they are faced with higher labour market stress due to elevated likelihood of longer-term unemployment and reduced employment options.

Third, individuals in vulnerable groups that reside in provinces having a weak labour market may be at a higher risk of elevated financial stress.

Fourth, the recent recession and economic recovery brought only slight improvements to the conventional savings out of income; at the same time, accumulation of savings through wealth has been weakening in the past several years. Neither active savings from income, nor passive savings through equity are evenly distributed across provinces and households. The lack (or low levels) of active savings may jeopardize individual’s ability to pay and honour debt obligations in the future.

- srbp -

09 June 2011

The looming debt problem

The government’s favourite economist is sounding alarm bells about the provincial government’s financial health. The finance minister, on a local talk radio program, sounding stressed as more and more people start talking about what has been obvious to readers of this corner for some years now: the provincial government is in a financial jam and the current crowd running the place have no idea what to do about it.

Well, if they do have an idea, they have no intention of doing anything, at least within the next four or five years.

Part of the charade they’ve been relying on the past few years is the perception that not only are happy days here but they aren’t ever going to leave. In some years, the finance minister hasn’t been above presenting completely laughable forecasts during the Christmas season to keep consumer spending going through one of the most tax-rich seasons of the year.

Just as the proverbial chickens are coming home to roost in Tom Marshall’s office, it may not be too much longer before a fewer fowl start fouling other bits of the province.

Last week local news media mentioned a report on consumer debt. Newfoundland and Labrador saw the largest jump in the country last year – along with Quebec – at 7.8%. As CBC reported, the average consumer in the province owes $23, 372. That doesn’t include household mortgages.

Flip back to March and you’ll find a red flag on that issue. It was a report by the Bank of Montreal that warned Canada’s housing prices were getting perilously close to a “correction”: especially in places where prices were outstripping incomes or if inflation rates changed rapidly.

Marketwatch.com’s Bill Mann summarised it this way:

The cautionary Bank of Montreal report says average home resale prices compared with personal incomes are 14 per cent above the long-run trend, up from last summer, although still below the 21-per-cent peak that preceded the 1989 crash.

But that is not the case in all Canadian real-estate markets. Five provinces are currently in the danger zone, led by Saskatchewan, where the ratio is 39 per cent above historic norms. That province has a booming commodities industry, centered around potash and oil.

Also well above the long-run levels is Newfoundland, 34 per cent higher; British Columbia and Manitoba, 31 per cent, and Quebec, 23 per cent above.

Overall in the province, debt servicing costs are the lowest in the country according to the most recent report from the Certified General Accountants Association of Canada. But that doesn’t mean there aren’t pockets of risk. The CGAA also reported that incomes in the province fell short of previous growth: problem is the year they are referring to isn’t clear, even though the report was issued in 2010.

Just thinking about it for a second, one could easily imagine there are a couple of potential hot spots in the province. The northeast Avalon and western Labrador are experiencing particularly strong growth and that’s where you’d be more likely to see heavy debt loads and high debt to income ratios.

Let us start with household debt. Since the beginning of the recovery, household credit has increased at twice the rate of personal disposable income. In the autumn of 2010, Canadian household debt climbed to an unprecedented level of 147 per cent of disposable income (Chart 7).

The relatively healthy financial condition of Canadian households at the beginning of the “Great” Recession helped the Canadian economy to better withstand the initial shocks of the crisis. However, going forward, it is essential to maintain the necessary room to manoeuvre to keep household spending on a viable path. This leads us to believe that the rate of household spending will more closely correspond to future earnings, and certain signs to that effect have already been observed.

Here’s Chart 7 from the speech:

The other two issues were international competitiveness and productivity and investment.

There’s a parallel between the condition of the provincial government’s books and the household accounts in some areas of the province. Just as the provincial government has grown increasing susceptible to small shifts in economic circumstances, so too may more and more households in the province be vulnerable to shifts in the provincial economy.

If the province’s politicians scarcely recognise their own financial problems, it makes you wonder if they might be aware of the issues looming for consumers in the province.

- srbp -

08 February 2011

Building permits value drops again in December

Permit values during 2010 peaked in October at $191 million.

14 January 2011

No Muskrat Falls in BMO forecast

Curiously, BMO’s latest economic forecast for the province doesn’t include any reference to Muskrat Falls.

The bank’s economists forecast overall economic growth in the province of 3.,9% in 2011 driven by provincial government infrastructure spending totalling $5.0 billion “over the next several years. BMO says that the province’s capital spending hit 3% of the province’s gross domestic product in 2010.

BMO forecasts continued strong capital spending over the next three years. While the bank mentions Hebron, Hibernia South and Long Harbour, there’s no reference to Muskrat Falls. That stands out like the proverbial sore thumb since the forecast is up-to-date enough to note the change in Conservative leadership late last year. it’s also odd because the forecast of capital spending comes entirely from the provincial government’s figures.

- srbp -

Related: Labour force indicators raise questions about economic health and competitiveness

16 November 2010

The Dismal Science: Debunking the “federal presence” fairy tale

Far from being hard done-by when it comes to federal jobs in the province, Newfoundland and Labrador is pretty much on par, according to a recent study conducted by the Frontier Centre for Public Policy, and reported by the National Post.

You can find a news release summarising the report here, while the full report is available in pdf format.

Some provinces - Prince Edward Island, New Brunswick, Nova Scotia and Manitoba – have significantly more than the national average number of federal jobs per 100,000 population. Quebec, Saskatchewan, British Columbia and Alberta have less.

Newfoundland and Labrador and Ontario are only slightly higher than the national average.

The study effectively refutes claims that this province is receiving something less than its “entitlement’ to federal pork spending. The comparative figures also demolish two reports released by Memorial University’s Harris Centre in 2005 and 2006. The provincial government has used those studies repeatedly to bolster its claims for increased federal transfers to the province to offset what turn out to be imaginary grievances.

The Frontier Centre study refers to these federal jobs as a form of “stealth” Equalization. That is, they contend that the federal jobs serve as a type of federal transfer to the local economy in each of the provinces. More importantly, though, the Frontier Centre contends that the transfer comes in addition to the formal Equalization program and is particularly heavy in the provinces it refers to as “major” have-provinces.

The study also notes that the have-not provinces with the highest ratio of federal government jobs also tend to have higher than average reliance on provincial public sector jobs generally. They compare provinces based on the number of public sector employers as a share of the total population. Newfoundland and Labrador is third highest on that scale, with Prince Edward Island and Manitoba coming, respectively, first and second.

Looking at the same information but as a share of the provincial labour force, Newfoundland and Labrador is by far the province with the largest dependence on the public sector. Almost 30% of the provincial labour force is employed by the federal, provincial or municipal government.

The Frontier Centre study puts the findings into a particular context, namely transfer payment reform:

The stealth equalization of unbalanced federal employment described in this paper is part of a much bigger problem —an approach to public policy in Canada that transfers money out of high-productivity regions into low-productivity regions.

Not only is this policy approach harmful to our productivity growth, it is also, quite simply, unsustainable. Historically, the taxpayers in three provinces—British Columbia, Alberta and Ontario, have paid most of the bill for high levels of public sector employment in the have-not provinces.

At the same time, the study does point to issues that are especially relevant to Newfoundland and Labrador, even if the report’s authors simply missed the poster child for their argument of unsustainable public spending and the dangers of reliance on what the author’s call “the state driven approach to economic development”.

Most residents of the recipient provinces are unaware of the extent to which their economies are state-driven and reliant on transfers. Beyond the official equalization money, massive amounts of revenue from elsewhere flow into these provinces from a number of different sources. Stealth equalization through federal employment is one important example—but there are others. Higher dependence on federal

government transfers to individuals and discrimination in ordinary operating programs in favour of the have-nots are two more examples of ways Canadian public policy transfers wealth into the have-nots.

Most residents of Newfoundland and Labrador are unaware of the extent to which the provincial economy is state-driven and reliant on federal transfers in addition to overall public sector spending.

They aren’t alone, of course. The current provincial administration operates as if going off Equalization was a tragedy of biblical proportions.

- srbp -

Related:

- Fragile Economy: staying the course

- Fragile Economy: reductio ad argentum

- Fragile Economy: The public sector

- Fragile Economy: …and two steps back

- Fragile Economy: …now three steps back and loving it

08 November 2010

Crude up, but what does it mean?

Crude oil finished the week on a high, with Brent coming closer to US$90 a barrel than at any time since October 2008.

That’s good.

Right?

Well, maybe.

Certainly, in the short run it brings in some extra cash. The provincial government low-balled production estimates in the spring budget but the actual production level only offset prices below the forecast average of US$83. in the end, the forecast oil revenue will likely not be far off the actual budget projection of $2.1 billion.

Don’t be surprised if it is more like $2.5 billion. if that’s the case, then the current budget is the first one in a long while where the provincial government gave figures that were close to the actuals.

Unfortunately, the budget forecast a cash deficit of around $900 million.

Two things will help bring that number down. First, production at Voisey’s Bay – even allowing for a strike – might start pushing government’s mining royalty back up to where it was before the recession.

Second, and perhaps most likely, the provincial government could be way off in its capital works spending. This is – you will recall – a government that has a real problem getting the job done. If someone could come up with a little blue pill for it, these guys would buy it by the container load. We are talking projects announced in one year, forecast to end in a couple and they only get around to tendering the thing at the end of the two years. Delays and massive cost over-runs are routine.

Things would be a lot clearer if the provincial finance minister issued a mid-year financial update in September as he should. That’s halfway through the fiscal year. As it is, he will say something in December. If last year is any indication, he’ll toss a load of sheer bullshit into the public mix in the hopes of keeping people lined up at the counter spending cash for Christmas.

The we just have to keep an eye on crude prices. Oil is still the biggest revenue source the provincial government has. Things are fine as long as oil stays where it is now. But when the markets can show an eight dollar a barrel increase in as many days, they can equally show a drop if the factors come together in the right way.

If the provincial government plans to unleash a year of election spending at the same time as the markets start to sort themselves out, this could prove to be a very interesting year indeed, right up to the next provincial election.

-srbp-

30 September 2010

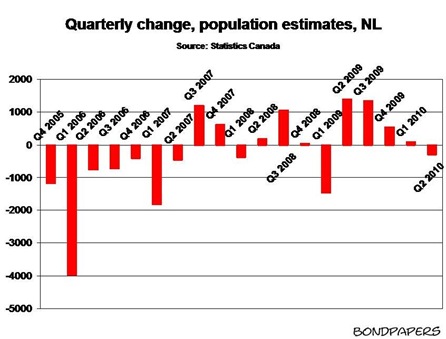

NL population drops in Q2 #cdnpoli

Newfoundland and Labrador was the only province to experience a population loss in the second quarter of 2010, according to figures released Wednesday by Statistics Canada. The cause is primarily net interprovincial outflows, in other words outmigration. That’s also the first drop since 2008.

While the provincial government issued a news released last quarter trumpeting the gain of a mere 96 people, you are unlikely to see a release like it this month talking about a drop three times the size.

Here’s what the past five years looks like, by quarter.

Now it could be nothing at all but a blip. Then again, it could be a sign of things to come. Note that for the last three quarters the rate of growth has dropped dramatically. That suggests the steam was going out of things and that the Q1 results were the peak of the curve.

You can see that more clearly if you look at this chart:

And actually, this could also mean that the North American economy is on solid footing. The change in migration patterns for Newfoundland and Labrador in Q3 2007 actually heralded the onset of the recession. A long-term analysis of provincial population suggests that the population grows shortly before major recession. Those are all people working elsewhere with relatively weak ties to the community who opt to come back to the province to weather the economic storm. When things pick up, they head off again.

And as much as the province’s finance minister may like to believe otherwise, odds are that is what’s going on again.

Great news, wot?

Well, not really. The longer term demographic problems that come with that aren’t ones the current administration and its unsound financial and economic management are not ready to cope with. Not by a long shot.

Don’t forget that in this pre-election and pre-leadership period, you can bet the government won’t be willing or able to do much to start adjusting to cope with the harsh reality of the economy and demographics. In fact, the next 18 months are basically a write-off for serious government decisions to deal with the problem.

On top of that you can forget the period between the election and whenever the new Premier arrives to replace the Old Man. And if that doesn’t wind up happening happen until a couple of years before the 2015 election you can almost write off dramatic policy shifts until that election is history as well.

Wow.

Not to worry sez you. There’s oil.

Sure there is.

Unfortunately, production and royalties won’t be able to cope with the demand for added revenue. There’s not much else going on to take up the slack and for good measure, the current administration plans to use oil money to fuel increases for education and health care and use exactly the same money to build the $14 billion Lower Churchill project.

Here’s lookin’ at you, kid…

…as you leave the province again.

At least we’ll always have Ottawa.

- srbp -

28 September 2010

St. John’s housing market feels national slowing trend

From RBC Economics:

Atlantic Canada’s housing market was not immune to the significant slowdown in activity that has swept across the country since spring. In the last few months, housing resales in the region fell back to the lows reached during the late 2008 to early 2009 downturn. The decline was felt across the board, including areas, such as St. John’s, which were on a tear earlier this year. The cooling in demand loosened up market conditions a little – they were very tight at the start of this year – and restrained home price increases. In turn, this limited the rise in homeownership costs in the region. Depending on the housing type, RBC Housing Affordability Measures moved up between 1.1 and 1.5 percentage points in the second quarter and remain very close to long-term averages. Overall, housing affordability in Atlantic Canada

continues to be quite attractive and signals little in the way of undue

stress at this point.

- srbp -

10 September 2010

RBC lowers NL GDP forecast for 2010

Highlights of the latest RBC Economics forecast for Newfoundland and Labrador in 2010:

- Real GDP to grow at 3.3% for the year, down from the 4.1% forecast in June.

- Offshore oil production down 3.2% year-to-date to June.

- Non-residential capital construction to form basis of growth in medium term.

- Oil royalties expected to reach 40% of provincial government revenues in 2010, potentially supporting increase in public sector employment. RBC states that public sector represents 30% of employment in the province.

- Real GDP growth of 3.3% forecast for 2011, up from previous forecast of 2.3%

And for the national comparison:

- Saskatchewan will lead the country in real GDP growth with 2010 and 2011.

- NL is middle of the pack for 2010 and third in 2011 for GDP growth.

- NL has recovered less than 60% of the jobs lost since the recession. Quebec has recovered 140% and Nova Scotia has recovered about 100%.

- srbp -

20 July 2010

Forever blowing bubbles

We are in a bubble. I think we are in a protected bubble.

That’s Danny Williams making a few observations at the close of the most recent session of the provincial legislature.

It’s not the first time Williams talked about bubbles. He said the same thing in October 2008 as the world headed into the worst recession since the Great Depression in the 1930s:

We now, for the first time in our lives, are in a bit of a financial bubble and that's a wonderful thing. We have that protection and the people of this province got the support of the provincial government

Williams even claimed during that call to a radio open line show that “[h]opefully our [budget] surpluses will continue, hopefully they'll get even larger, it will enable us to do the things that we've been doing. I mean this, for us this hasn't happened overnight. We've been preparing for this.”

Then the talk of surpluses and bubbles disappeared.

You see, bubbles are wonderful things, all pretty and shimmery in the sunlight.

But bubbles are flimsy and insubstantial.

Bubbles have a distressing tendency to burst.

And in the case of the Williams economic bubble, the whole thing burst quite spectacularly. The provincial gross domestic product dropped 22% in 2009, or 10.2% in real terms as RBC assessed it. Deficit spending became the new order not just for the day but for the years to come and cabinet ministers openly admitted provincial government spending was unsustainable.

Now for those reasons alone it was nothing short of bizarre to see Williams return to the complete nonsense that somehow the province – let alone the provincial government – had emerged from the recession safely wrapped in some sort of bubble. It was even more bizarre to see Williams repeating this line:

However, when I look at what is happening here in Newfoundland and Labrador, the fact that we do have our debt reduced,…

It’s bizarre because it simply isn’t true. The total public sector liabilities remain as high in 2009 as they were at just about any point in the last five years. Even the net debt – government’s favourite misleading measure – increased as the 2009 cash shortfall sucked up a half billion dollars of cash the government had laying about and which had previously been used to offset government’s liabilities, even if only paper.

Williams went even beyond those crazy remarks, claiming that the previously unfunded pension liabilities had been addressed. Of course, that isn’t correct either. As Budget 2010 forecasts, the unfunded pension liabilities will increase in the current fiscal year just as the net debt will increase.

So aside from a decidedly unhealthy dose of self-delusion, it’s pretty hard to tell what the Premier was getting on with in the House of assembly only a month or so ago.

The prospect of a second and prolonged recession - widely discussed for some weeks now – only makes the premier’s claims that much harder to fathom. If the United States economy slows down again, then the Newfoundland and Labrador economy will follow suit. Williams’ own economic policies have seen to that.

If economist George Athanassakos turns out to be right, things in Newfoundland and Labrador could be even worse:

Economies are still extremely vulnerable to speculative bubbles and dips and increased volatility. The panic of 2008 and the subsequent rescue packages did not provide the necessary catharsis that recessions bring to economies. Demand for broader reforms has also waned as a result of the rescue of the economy from the panic of 2008. If this were not enough, economies have become addicted to low interest rates and to liquidity infusions.

Rather than being protected by a bubble, Newfoundland and Labrador may be more vulnerable to a second economic downturn than other parts of the western world. First of all, more and more of the local economy under the Williams administration is based on unsustainable public sector spending.* Second of all, the metro St. John’s area housing explosion - even as it subsides – has been built on public sector spending coupled with low interest rate policies. A second recession will likely kill both of those simultaneously.

Incidentally, the most recent figures from Statistics Canada suggest that the construction boom in Newfoundland and Labrador isn’t a commercial one.

Even as spending on the Vale Long Harbour project, Hibernia South and Hebron ramp up in 2012, they won’t be able to offset a decline through all other sectors of the economy. And that’s even allowing that oil prices don’t drop thereby putting development of Hebron in some doubt.

The forest industry is a pale shadow of what it was even a half dozen years ago. The fishery is mired in restructuring talks. In any event, the industry is woefully short of the capital investment needed to sustain itself let alone retool for global competition. Destroying Fishery Products International and selling off its most useful and lucrative assets will prove to be one of several catastrophic policy failures of the current administration.

Mining may be doing reasonably well in the year ahead, but a second global recession will also adversely affect commodity prices. Even if oil prices remain at current levels, declining production over the next two to three years will reduce government revenues significantly.

Meanwhile, provincial government cash deficits in 2010 and again in 2011 would rapidly eat up whatever cash reserves are on hand. A significant economic downturn through the latter half of 2010 and into the 2011 election could force the government into a difficult financial position likely meaning spending cuts and wage freezes.

The province is not protected by a bubble. It is subject to the same forces that affect the rest of the world. Far from insulating the provincial economy from global forces, government policy has left the province in a more precarious position than it has been in two decades.

That’s the thing about bubbles. Like delusions, they have a tendency to burst in the most unsettling way imaginable.

- srbp -

* The growth in the provincial public service in recent years is not just a relative growth owing to a decline in other sectors, like forestry. From labradore:

In the past decade, the absolute numbers of people in NL who work in the provincial public sector — the provincial civil service, public health care, social service, and education system, and public post-secondary education institutions — has increased by 35%. Not only is that the largest increase, start to finish, of any of the ten provinces, for most of the decade, NL has topped the chart in terms of the growth rate. And, starting in 2006, that growth curve spiked steeply upwards, with annualized growth of up to seven percent per year, unmatched by any other province except, starting in the second half of 2008, Prince Edward Island. [Emphasis added]