While she is telling others to stand by for tough budgets and tight times, Premier Kathy Dunderdale is planning to spend more than $3.0 billion in accumulated oil surpluses to build the Muskrat Falls dam.

Now that is no surprise to SRBP readers nor is it a surprise to people who’ve been paying attention to information disclosed as part of the public utilities board hearings into the project.

Nalcor boss Ed Martin confirmed it on Tuesday in a call to Randy Simms on VOCM’s Open Line. Here’s the relevant bit of the Simms and Martin exchange:

Randy Simms: Government of Newfoundland?

Ed Martin: And the Government of Newfoundland will also be putting some equity in as well. They’ll transfer cash to us to put in as equity.

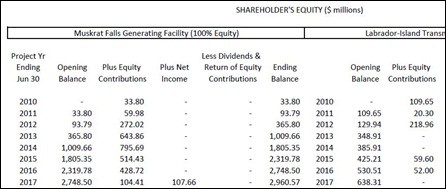

Simms didn’t ask how much, but the amount is right there in Nalcor’s answer to a question from the PUB. CA/KPR-NALCOR- 20 includes a table that lays out the “Stakeholder Equity”. The only Nalcor stakeholder is the provincial government.

Note that it shows financing for the generating facility is 100% equity. The amounts shown in the column “Plus Equity Contributions” adds up to $2.853 billion. That’s the cash transfers Martin was talking about.

On the other side, the ledger shows another $460 million in equity – cash, that is – and that represents 25% of the cost of the transmission line.

What’s most interesting is that Martin didn’t discuss 100% equity with Simms, even though the Nalcor submissions to the PUB discuss it repeatedly. Martin said:

The 60 / 40 is generally what it is going to be. That may end up being 57 /43 or whatever. But it will be around that.

60% debt.

40% cash, that is equity.

Still, it would likely be safe to start from the premise that Nalcor’s calculations and the provincial cabinet’s endorsement of this project is based on having very little public debt, except on the transmission lines. That’s a pretty wild assumption, of course, given the provincial government’s miserable experience with delivering capital works projects on time and close to budget.

Still, if they think they can do it, Nalcor and the provincial government might be tempted to believe they can get the whole thing for cash on hand with only a few hundred million in borrowing. As Martin noted, Nalcor will use other revenue of its own – like from the equity stakes – to add more cash to the pile if need be.

That would also explain how they think they can keep electricity rates low. Without much of a debt load to repay, they can just cream of any profits. If things are worse than expected, the provincial government just won’t make any money back on the project at all. They’ll tell the punters that their great dividend from oil and gas is discount electricity.

You can see that kind of thing in Ed Martin’s closing remarks:

But any cash that goes into this project, any returns that come from it, are staying in the province and results in 100% ownership of an asset for the people of Newfoundland and Labrador, essentially forever.

Sounds wonderful.

Sounds marvellous.

Sounds fantastic until you realise that Martin knows that this project won’t sell electricity anywhere but inside the province.

That means that the people of Newfoundland and Labrador will pay for the Muskrat Falls project up front with their billions in cash from oil.

Then they will pay for all the electricity that comes from it, including the stuff shunted off to Nova Scotia for free.

In effect, the people of Newfoundland and Labrador will be paying themselves back for the money they borrowed from themselves in the first place.

In order to make that work and to keep the electricity prices at a rate people wouldn’t scream about, the provincial government and Nalcor plan to let the people of the province pay themselves back over the course of a half century.

Now you can understand that all this makes a bitter lie of the claim by project proponents that this project will have a revenue stream and pay for itself. The only “revenue” is what the ratepayers will pay annually for their electricity. As SRBP noted before, people will be forced to pay for the costs annually plus a profit because that’s the way the public utilities board sets electricity rates.

Don’t miss the point though - Muskrat Falls is not a revenue stream: it is a tax on the people who own the resource in the first place.

One can scarcely imagine or a more cynical political gambol with public money.

- srbp -

.