The people who run the province’s town and cites are looking to get a new financial arrangement from the provincial government.

Last week, the municipalities federation held an emergency meeting to discuss recent developments:

“What we’re asking government for today is very clear,” said Rogers. “Short-term help in this 2012 budget and a commitment to participation in the development of a long-term, strategic plan for the municipal sector.”

Sounds reasonable enough.

Odds are they won’t get anything in the near term. Give a listen to what municipal affairs minister Kevin “Fairity” O’Brien said at the outset of an interview with On Point with David Cochrane this past weekend. O’Brien quickly started into a recitation of how much money the provincial government has spent since 2008 on municipal infrastructure and things like fire trucks. he finishes off with the warning that any new financial arrangement has to be sustainable for taxpayers.

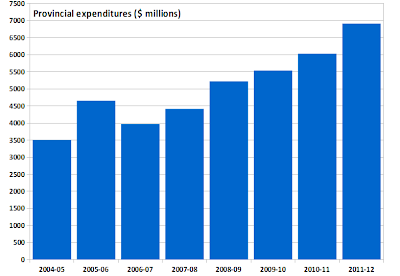

Coming from a guy who has helped boost provincial government spending to irresponsible, unsustainable heights without a toss about such ideas, those words sound a bit like a lead bell.

O’Brien is using coded language.

What he really was telling municipalities president Churence Rogers is a simple “f*ck off”. No one should be surprised if Rogers has heard something along those lines over the past few weeks, perhaps even from O’Brien himself. Maybe no one used the “f” word exactly, but language likely would have had the finger buried in it.

You see it all comes down to money, power and control.

Right now the provincial government has all of it.

And they will not give up any of it.

The provincial government isn’t interested in changing municipal funding at all. Any change to funding would have to transfer some of the provincial cash or the ability to raise cash over to the towns and cities.

If the province doesn’t have that cash, then it no longer has the power to control what goes on in the province. Fairity O’Brien may not have deliberately mentioned infrastructure and fire trucks, but there’s no coincidence that he did. That money and those items are part of the old pattern of politics in this province: patronage.

And that’s the money, power and control we are talking about.

None of that has anything to do with the very serious problem in many towns and cities in the province but frankly provincial politicians like O’Brien don’t give a rat’s backside about that.

Many parts of the province aren’t really doing all that well, despite the reports you may have heard. They don’t have the municipal tax base to come up with the sort of cash of their own they need to put into road work, water and sewer projects and other infrastructure.

Problems in the fishery, the loss of paper mills have all taken their toll. People may be working in Alberta and still living in Stephenville and Grand Falls-Windsor but it’s local companies that pay the taxes that help to keep the street lights on, quite literally.

What’s more, way too many of the towns on the island are full of retirees and not much else. People on fixed incomes don’t have the ability to tax up the tax slack. Those towns also have problems finding people to volunteer for municipal services like firefighting.

There’s a bit of a false impression of a boom in some places. People in Grand Falls-Windsor thinks everything is smurfy. Ditto Gander. But in both these towns the major economic engine is the provincial government and a level of spending that we know is unsustainable.

What’s more, the provincial government doesn’t pay taxes to municipalities. They do – however – collect taxes on every municipal purchase through the harmonised sales tax (HST). The effect is to claw back a portion of the money the province grants in the first place. Until the fictitious oil royalty claw back, though, this one actually reduces the amount of money the towns and cities in the province have available to actually spend on services to residents.

And then when towns and cities go looking for cash, politicians like Kevin O’Brien start coming up with all sorts of excuses for why things must remain as they are. The miserable, dark joke in all that shouldn’t be lost. Towns and cities in the province are looking for a fair shake on provincial funding. Kevin O’Brien is the guy who told us all that the province just wanted “fairity in the nation.”

David Cochrane exposed the fundamental bullshit of government’s position. Cochrane asked why it was that O’Brien was talking about the impossibility of making commitments of funds for a few millions in the short term to towns and cities while government was prepared to forecast the price of oil for 55 years in order to justify Muskrat Falls. All O’Brien had was talking points.

O’Brien also couldn’t explain or justify the four years that it has taken for O’Brien to start getting around to talking about a new financial arrangement for towns and cities. Municipal leaders have asked for predictable funding. All O’Brien has said is that he and his colleagues in government are willing to talk.

The real bottom line is that people like O’Brien who have politicized the purchase of bed pans and fire trucks simply want complete control over spending in the province for their own, pork-barrel, patronage reasons.

All municipal leaders want is fairity.

They aren’t going to get it from Kevin O’Brien.

- srbp -

.