In the next of this series of snapshots of the provincial government’s financial state, let’s take a look at few more charts.

First, there’s net debt. That’s the sum of assets less liabilities. This table was taken from data compiled by RBC economics from provincial budget documents going back to 1981. The scale on the left is measured in millions of Canadian dollars.

The jump in 2003 is one your humble e-scribbler can’t readily explain and there seems to be some discrepancy in the government’s financial statements. RBC has used the second set of figures but there seems to have been a revision done in 2004 to the figures for the previous year.

The big drop over the two years between 2006 and 2007 is attributable to one thing and one thing only: a doubling of the provincial government’s financial assets, basically represented by temporary investments. That’s all oil royalties flowing from deals struck before 2003.

So when you see the provincial government crowing about debt reduction, they are really talking about the increase in cash they have, not the real reduction in liabilities. There is $1.8 billion in temporary investments held by the provincial government directly and another pile of cash and on-financial assets in various agencies and Crown corporations that brings the total assets up to $4.4 billion. The $12.4 billion in liabilities minus the $4.4 in assets gives you the current net debt of $8.0 billion.

That’s clear from the second chart which shows only the liabilities as presented in the Public Accounts from 1998 to 2008.

Now some smarty-pants will notice that there hasn’t been a huge drop since 2005 that would equal the $2.0 billion plus a few more contributions that brought down the unfunded liability. Well that’s because there have been some other liabilities incurred since 2005, like some new borrowing. Overall, though, there has been a reduction in the total liabilities with the biggest reduction being the change in unfunded liabilities.

Incidentally, that pension liability is still there but there is now cash to deal with it.

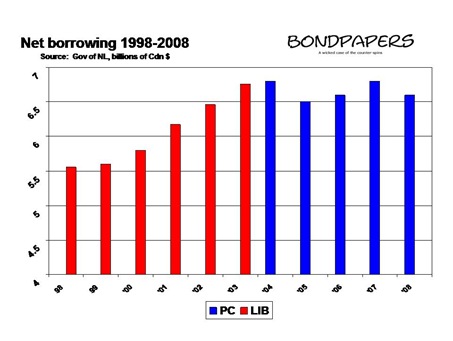

Now as a last chart, let’s take a look at the net borrowings numbers. We looked at the net borrowings per capita, but let’s look at the actual net borrowing figures for the past decade. Remember that net borrowings are the total amount borrowed less any money set aside to pay the debt when it comes due.

-srbp-