The view of Iceland then, for some. [h/t to Daimnation!]

His outline of how Iceland went from poverty to prosperity in less than two generations is an inspiration to the ambitions of small nations. In Newfoundland, the "Iceland Model" is a Holy Grail for politicians but they have a mental block when it comes to the reality that Newfoundland does not have control over certain economic policy that Iceland, as sovereign state, has and can make "top-level" policy to direct their economy. Fisheries management is only one example. While on the surface, Newfoundland and Iceland may appear to have a lot in common, in reality, they are two different planets. The nationalist minded in Newfoundland eye Iceland doe-eyed as the future Newfoundland never had.

Iceland now.

For the fans of prognostication, the Offal News view in 2007, and for those looking for the Bond-able treatment, you can check out:

- Iceland's miracle: the other side (December 2006):

Well, one of the costs of Iceland's supposed economic miracle is a currency that is dropping against the Euro. As a result, the Icelandic central bank has raised interests rates to 14.25%. It's been about 15 years since we've seen those kinds of interest rates in Canada.

Investors are keeping a close eye on the Iceland situation since the whole economic tension is coming from a government deficit on current account that is running at 27% of gross domestic product in the third quarter.

To put that in context, that's the equivalent of the provincial government here running a deficit - in a three month period just ended - of around $1.35 billion. That's just in one quarter, and assuming the economic output in the economy right at the moment is about $5.0 billion per quarter.

- Beowulf it ain't (August 2006):

But anyway, if this little story is right Danny Williams is going to look at how Iceland generates energy since "if it can be done there, it can certainly be done in" Newfoundland and Labrador.

Minor problem.

Iceland happens to sit on some pretty special geological real estate such that they country has active hotsprings and a volcano that's been known to erupt every so often. 87% of the country's heating needs are supplied by geothermal energy. That's heat from the Earth to you and me.

So of course, not everything done there can be done here.

- All trout live in trees (June 2005):

As noted in previous posts on this subject, the syllogism Iceland = Independent = Successful Fishery//Newfoundland=Not Independent=Fisheries Disaster doesn't stand up to closer scrutiny.

The idea of an independent Newfoundland managing the fishery as Iceland rests on a series of unfounded assumptions.

The local nationalists pushed the Iceland thing as hard as they could but events of the last few days have demonstrated unmistakably that their arguments were built on nothing but air.

A bit like the cartoons where the guy winds up running off the end of a cliff, only to find himself a few hundred feet up in the air.

Then he looks down.

Yep.

That's gotta hurt.

-srbp-

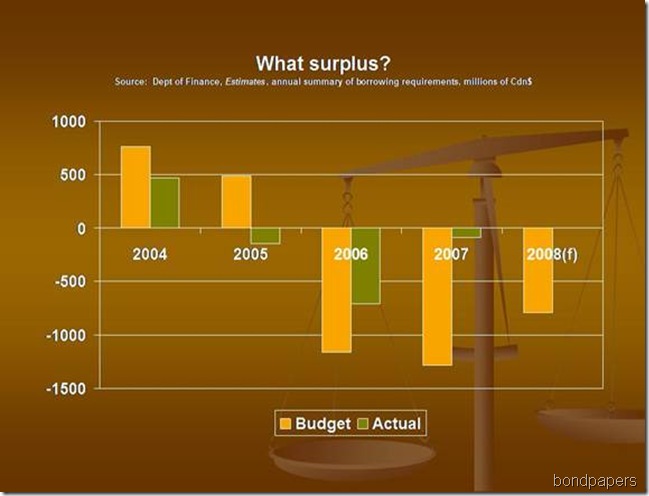

We got surpluses and ones that Williams hopes will get bigger.

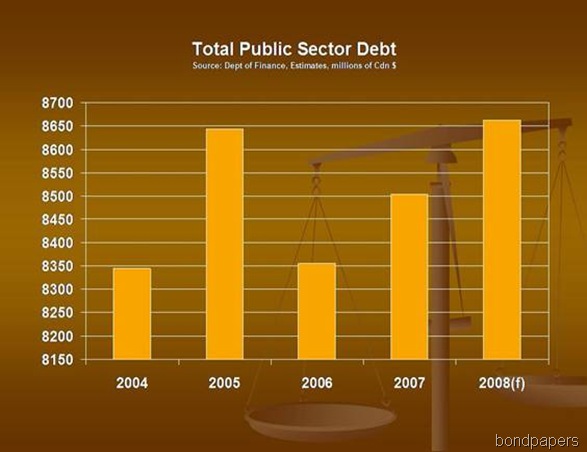

We got surpluses and ones that Williams hopes will get bigger. The debt has been going down.

The debt has been going down.