Newfoundland and Labrador is usually one of the last places to catch a trend. Doesn't matter if you are talking fashion or, in the latest version, government economic and fiscal policy, it seems to take a while for things to catch on here.

Late on Friday afternoon newly minted finance minister Jerome Kennedy issued a news release trumpeting a credit rating by Standard and Poor's as proof of the provincial government's "fiscal prudence and sound policies".

Well, maybe catch up is the better word.

There isn't a government left in the developed world that is still pushing the sound fundamentals media line now almost two months after the start of the current global economic crisis. No government is claiming some sort of credit for being able to weather a storm that, in many minds, is far from over.

Well, no government except the one here.

If you want to understand why everyone else's tune has changed, take a look at the five year trending in crude oil prices. You can find an example in the WTI futures box on the right hand column. Click on the "5Y" symbol.

Four years to get up to US$147 a barrel and a mere four months to tumble below US$50. The steepest declines have come in just the past two months.

The speed of the price collapse should be a clue to analysts that the assumptions used before July to predict that oil would remain at unprecedentedly high prices for the rest of time were faulty. The security premium, supply concerns and overheated speculation drove prices to the peak last summer but in addition to all that the superheating of the global economy, fueled by loose American regulations pushed things beyond anything that would be considered normal and rational.

In other words, the price of oil has been artificially high for a very long time. Given that markets have a way of correcting themselves at some point, it was really only a matter of time before a correction - a downturn - took the heat out of things. The only thing that couldn't be foreseen, and that's about the only thing, was how steep a correction was coming and how it might last, but come it would as surely as it has come at every juncture in the past.

Fewer and fewer analysts are holding to the old projections, some of them dating back several months. Some of the more influential sources, such as the International Energy Agency, are forecasting high prices. However, many are revising their short term projections markedly downward. Deutsche Bank, among others, is projecting crude at US$40 per barrel by April 2009. One analyst - Robin Batchelor - who in May 2008 predicted high oil prices well into the future is now likening the current climate to one 30 years ago:

"On the upside it always overshoots and the same is true on the downside. What I’m looking at is the commodity supply and demand equation; long term there are still supply issues but on the demand side we’re facing downdraft," he points out. "The last time we had a fall of that magnitude was in 1979/80/81."

While Batchelor for one has not abandoned his high price forecasts, he has certainly altered his view dramatically. The reason is simple. While he and others once assumed ever increasing demand, the current correction may alter the demand side of the price equation that can't be seen right at the moment. If the current downturn lasts well into 2009, as most expect, the IEA, among others, will likely go back and rethink their projections just as they revised their assumptions three years ago when they thought US$50 a barrel was the peak.

Closer to home, though, the hope in the old assumptions remain strong close to home. This week, economist Wade Locke told Memorial University's student newspaper The Muse that:

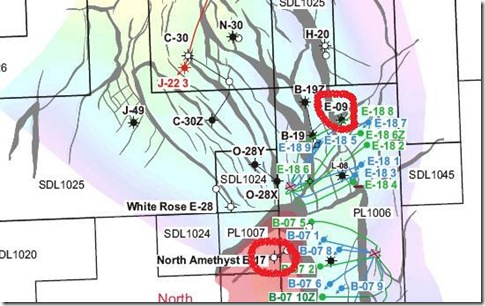

“The longterm [sic] price forecast is still in the $80- to $90-range for oil and that will not affect Hebron, White Rose Extension, or Hibernia South. Even if [oil] prices were to stay around $60, these projects would likely proceed,” he said.

Locke's comments are a useful segue to an interesting aspect of the local view from the provincial government and its supporters. Locke certainly falls into that category and the similarity between his comments and those of the finance minister are striking. With that quote from The Muse in mind, take a look at this one from the release on the credit rating:

"Our economy remains strong and the current economic downturn should not affect development of new oilfields including White Rose Expansion, Hibernia South and Hebron," said Minister Kennedy.

The phrasing is similar, much like the similarity in early October between Locke's and the Premier's references within days of each other to the government being able to meet and exceed its current budget targets even if oil falls to $10 a barrel.

But what's more interesting in these two comments is that neither is completely true and in the wider context of Locke's comments on a bright future based on oil wealth, they constitute a fixation on oil as the source of economic salvation not seen in this province since "1979/80/81."

Let's deal with the projects first.

The White Rose expansion is a relatively modest project. With its development costs already recovered, oil would almost have to hit prices lower than the historic 1992 price of US$8 per barrel to make it economically dodgy.

The Hibernia South extension is also not a pricey project measured in terms of the original Hibernia project or Hebron. However, there is no development application yet and a decision to proceed would certainly be affected by oil prices significantly lower than the current ones.

In all likelihood, the project will go ahead given that the oil companies have at their doorstep a provincial government willing to invest hundreds of millions of very scarce tax dollars in the expansion since that ultimately lowers their cost. Given they will have recovered their initial costs by the time the new fields come online, their profit position would improve immensely in such a scenario while it would be the junior partner who would see a relatively lower return on investment. Low oil prices - especially below the foolish fixed price trigger of the current government's oil super-royalty regime - won't affect them as much as it would the new kid in the oil patch.

Hebron is the most costly of three projects and the one most likely to be affected by a long period of low prices. Analysts seem to agree that the current price climate makes investment in high cost ventures like offshore heavy oil, deep water projects and oils sands less attractive. Hebron's reported financial tipping point - US$35 per barrel - is well below that of an oil sands project but stop and look at current prices.

There's a reason why the companies insisted on a clause in the Hebron agreement which gave the partners - and the partners alone - the right to take up to a decade to sanction the project. Current Hebron timelines are merely works in progress, subject to revision is the financial climate changes.

The upside for Hebron is that the companies managed to secure several significant concessions from the provincial government as hedges against a drop in oil prices. Those concessions make it more likely the project will proceed.

First, they secured the decade to sanction with no penalty for deciding against proceeding. They have time to decide and there is no real cost for delaying if the numbers don't add up.

Second, they won the royalty concession that dropped the pre-payout royalty to a fixed 1% as opposed to the escalating scale of the old royalty regime. The energy minister herself heralded this as a major feature of the new deal.

Third, they were able to tie the super-royalty to a fixed price below which no extra cash was paid to the provincial treasury. By the government's own estimate, oil prices averaging US$50 a barrel over the life of the project produced less than half the royalties of a high oil price. Drop below that magic fixed trigger and the provincial share drops accordingly on top of the front-end royalty concession but from the company standpoint they can guarantee low possible costs across the board.

Fourthly, they secured significant fabrication concessions in the agreement. Most of the topsides work will be done outside the province anyway based on what appears to be a huge miscalculation by the provincial government's negotiating team.

On top of that, however, the management arrangement - including the provincial government as junior partner - would enable the companies to ship virtually all the topsides work and associated engineering outside the province in order to lower the costs and complete the project on time. If oil prices stayed low enough long enough and construction costs stayed high enough, it may well be worth the companies' while to pay the modest penalties for changes in the work commitments to get the deal done, even if they had to pay the penalties at all. A renegotiated contract arrangement with the provincial government's energy company and the government that changed the work commitments would likely never be made public under the revisions to the energy corporation act passed last spring.

The companies may well get their projects, but the return to the provincial treasury and the overall impact on the local economy may turn out to be far smaller than originally promised.

The fundamental problem in all this is the fixation on oil projects which has led the provincial government and its supporters to tie government finances to the price of a barrel of oil. Despite all assurances to the contrary, the next several years may be see provincial government fiscal problems as unprecedented as the surpluses of the past two or three years. Unlike those surpluses, however, the problems won't be figments of an accountant's bookkeeping methods.

Beyond that, prosperity for the province as a whole, in Locke's view, appears to be driven entirely by a couple of oil projects which, it must be noted, have a fixed life span. Neither Locke nor Kennedy - who echoed Locke's definition of prosperity - have not realized the folly of resting everything on the a very slippery commodity.

Oddly enough, it fell to Donna Stone, president of the St. John's Board of Trade to sound a very small warning bell against this very situation. Board of trade presidents are not known to buck the government line so her words stand out. As Stone told the Rotary Club of St. John's:

“This still gives us some cause for concern, however. Given the volatility of oil prices, the province should look at a long-term plan that will diversify our economy and make us less dependent on this ever-changing commodity,” Stone said.

Stone is absolutely right. Almost 20 years ago, the provincial government realized exactly that and implemented a broadly-based strategic economic plan to hedge against such dependence. That plan has been tossed aside in the past four years.

The consequences may prove to be dire and no amount of assurance that all is well will save us from the them.

Just remember what happened to Chip Diller.

-srbp-