“It's giving away their future.”

Danny Williams on the NB Power sale

__________________________________________________________________

At the heart of a little flame war last week on one local blog came a rather surprising nugget of hard news that Newfoundlanders and Labradorians likely have never seen and may well never see covered at all – let alone in depth - by local media.

Telegram blog writer Geoff Meeker noted a comment by Premier Danny Williams in the House of Assembly on April 30, 2008. In answering an opposition question about putting $100 million into debt reduction for Newfoundland and Labrador Hydro, the Premier said:

It was a previous Liberal government that wanted to actually privatize Hydro. This particular government wants to strengthen Hydro, wants to make it a very valuable corporation: a corporation that will ultimately pay significant dividends back to the people of this Province; a corporation that perhaps some day may have enough value in its assets overall as a result of the Hebron deal and the White Rose deal, possible Hibernia deal, possible deals on gas, possible deals on oil refineries and other exploration projects, where hopefully we might be able to sell it some day and pay off all the debt of this Province, and that would be a good thing. [Emphasis added]

That’s right.

Danny Williams spoke publicly about selling off some or all of the province’s energy corporation to pay down public debt.

CBC’s provincial affairs reporter David Cochrane added to the discussion online and offered some additional insight into the Premier’s thinking:

We pulled him outside for a scrum to ask about it. Even before we asked a question he clarified his comments. He said he misspoke in the legislature. He wasn't talking about selling Nalcor. He was talking about selling the individual assets it acquires.

For example, if the Hebron stake is eventually worth 5-billion [sic] dollars and someone wants to buy, Williams said he would consider selling it to reduce debt.

That was consistent with past comments he had made when the government rolled out its plan to revamp Hydro into an energy company.

As established in the first part of this series – Control and Resources - that isn’t what Williams had been saying consistently at all.

To the contrary, selling any asset of the energy corporation would run directly counter to the stated goal of acquiring control over the province’s resources and hence its development and future. Being masters of our own destiny is tied directly to resource ownership.

But Cochrane was right: Williams had talked about selling some or all of the energy corporation before. As Cochrane showed, Williams had mentioned the idea in October 2005 in a story Cochrane had done on Ed Martin’s arrival as chief executive officer of the fledgling corporation that would be eventually known as NALCOR Energy:

Williams says his top priority is for the company to become an investor in every form of energy development – or, as he calls it, to get a piece of the action.

"I would like to see Newfoundland and Labrador Hydro gain a strong asset base, so in fact then the government of Newfoundland, as a shareholder, also benefits from that asset base," he said.

…

"If energy continues to grow in value as it is now, perhaps what we could now buy for a billion dollars could be worth $10- or $20 billion in 10 or 20 years' time, which means that those assets have a value whereby we could pay off our debt," Williams said. [Emphasis added]

The 2005 comment is not as clear as the 2008 version in the legislature but they are along the same lines.

And certainly in 2005, Williams wasn’t splitting hairs over regulated (electricity) versus non-regulated (oil and gas) assets as Williams apparently did in the unreported portion of the media scrum in April 2008. As Cochrane described it:

Williams did not say he would sell off all the assets (i.e power generation and transmission capacity). He was talking energy assets in the oil and gas sector.

Now while it doesn’t appear that Williams has said this “many, many times” as Cochrane asserted elsewhere in that comment, there is no question Williams has spoken of selling off some or all of the energy corporation in order to pay down public debt, if the price was right.

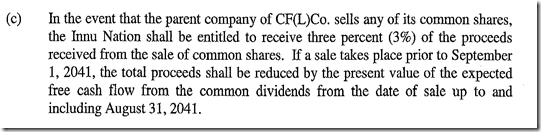

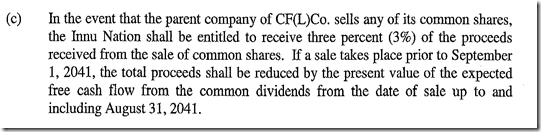

Nor is it the only reference to selling energy assets, even though the idea is not contained in the energy plan or the campaign manual. In a clause of the New Dawn agreement, released in September 2008, one provision covers the potential sale of the Newfoundland and Labrador interest in the Churchill Falls (Labrador) Corporation:

On the one hand, the Williams administration has a clear policy connecting the principle of control of energy resources with ownership of equity stakes in energy projects.

Yet at the same time, the Premier has spoken publicly about the potential that these assets could be sold to reduce public debt.

And on top of that, an agreement with the Innu Nation includes a specific provision covering the potential sale of the Newfoundland and Labrador majority shares in the company that operates the Churchill Falls power complex.

Clearly the two notions cannot live in the same space.

Well, they can actually if one considers another statement by Danny Williams which describes another aspect of his political philosophy:

What I said before and I said going in, this is about principles, but it's also about money as well. At the end of the day, the promise and the principle converts to cash for the bottom line for the people of Newfoundland and Labrador.

That’s a comment Danny Williams tossed out in November 2007 during the racket about broken political promises with Stephen Harper.

Williams used the word “principles” in the familiar sense. A “principle” is a fundamental rule. A “principle” may also be expressed as a value like openness, honesty, or integrity.

The dispute was a matter of principle, in that sense; a promise made is a commitment to act that must be fulfilled. If someone breaks his or her word without good cause or explanation, the relationships between people can no longer function.

But “principle” in the way Danny Williams used it on that occasion in 2007 identifies the “principles” as nothing more substantive than the basis for a claim of damages or the source of a grievance. Relief or compensation can be had by identifying a sum of money, or, as Williams puts it: “the principle converts to cash.”

But “principle” in the way Danny Williams used it on that occasion in 2007 identifies the “principles” as nothing more substantive than the basis for a claim of damages or the source of a grievance. Relief or compensation can be had by identifying a sum of money, or, as Williams puts it: “the principle converts to cash.”

The notion is hardly surprising for a lawyer who spent a lot of time arguing for damages for his clients, even if there are few others who would – on the face of it – accept that principles of any kind can be transformed to coin.

Yet Danny Williams obviously operates on the belief that he has a political Philosopher’s Stone in his pocket. Like its legendary alchemical predecessor that converted base metal to gold, this stone would convert electricity and oil into dollars.

The curious thing is that none of this has been reported clearly and consistently within the province. It is doubtful that a majority of Newfoundlanders and Labradorians know anything but the old and familiar notion that links control of resources with the future.

Yet there is no mistaking that the Williams administration has another policy firmly in place - at exactly the same time - which would allow for the sale of resources in a fashion that directly contradicts the notion of control on which the administration claims popular support for its policies.

Little wonder in April 2008 then that Danny Williams responded so strongly when reporters asked him to scrum on his statements. Again, as the CBC’s David Cochrane described it:

We pulled him outside for a scrum to ask about it. Even before we asked a question he clarified his comments. He said he misspoke in the legislature. He wasn't talking about selling Nalcor. He was talking about selling the individual assets it acquires. [Emphasis added]

In the end, the reporters in the scrum opted to report nothing of the comments at all, including the Premier’s “clarification.”

Regardless of what the reporters decided on that busy work day, the Premier’s comments and the unsustainable internal contradiction in them are obvious in both the Premier’s criticism in the legislature of Hydro privatisation on the one hand and then the expressed interest in flipping assets to pay off debt on the other. It doesn’t matter how often the Premier said it.

The comments take on new importance though given the Premier’s recent attack on the sale of NB Power to Hydro Quebec.

And at the same time, as the province faces tight provincial finances, the question of exactly what is government policy on energy, control and sale of resources to meet financial needs deserves to be answered clearly and unequivocally.

Such a question can only be answered, however, if someone deigns to ask it.

-srbp-