This one was strong.

From the Globe and Mail, December 2007:

Now, instead of the predicted poverty, there's the "Danny Williams effect" as the local economy surges.

A local real estate blog picked up the line;

The Globe and Mail printed an article on December 17, describing the recent boom in the Newfoundland Real Estate market. Dubbed “The Danny Williams Effect” after the recent Hebron offshore oil project, homes in St. John’s and surrounding areas (including Mount Pearl, Paradise, CBS, and Torbay) surged 68% from October to November.

Then they repeated it in a list of reasons to invest in “Newfoundland” real estate:

3. Danny Williams. Whether you like him or not, the “Danny Williams Effect” has certainly placed a positive spin on Newfoundland.

The phrase made it back around to the Globe, other news media and even the odd blog across the country via - you guessed it – a real estate agent trying to explain a local housing boom in St. John’s:

On the upswing is St. John's, N.L., which is expected to see a 12-per-cent jump in house prices in 2009, which ReMax says is due to the “(Newfoundland Premier Danny) Williams effect on the overall economy.”

You’ll also find the idea - if not the phrase - in a 2008 Policy Options article by a lobbyist for the provincial government’s oil company:

Newfoundland and Labrador premier Danny Williams has led his province from have-not to have status in the Canadian federation, thanks to offshore oil revenues.

That’s the way one photo caption put it. Or, from another part of the article, the same idea:

One of Williams’ skills, like other successful leaders before him, has been in understanding the temperament and desires of his audiences. He has used that ability with great aplomb to build a significant political support base in Newfoundland and in other parts of

Canada. His power is proportional to the strength of the provincial economy and solidified by circumstances that allow for the cultivation of a never before-seen “have” Newfoundland.

There’s that idea between the power of the economy and the power of The One.

And the cult of personality really didn’t just limit this amazing-ness to the economy. Memorial University political scientist Christopher Dunn even trotted out the idea of a Williams effect when it comes to politics generally. Now to be accurate, Dunn was really blowing a gigantic pile of smoke to cover over the fact he really didn’t have anything of substance to talk about.

Dunn refers to something he calls the “Williams effect” and claims it is a model others may emulate. But at no point does Dunn even try and describe what this “effect” might actually be. That’s a dead giveaway for academics, by the way. If they can’t tell you what it looks like, you know they are just making crap up.

Dunn’s not alone. The real estate hucksters basically put a name on something to capitalise on what was supposedly popular. That’s what hucksters do.

And the Globe reporter did what Globe reporters do with Newfoundland and Labrador: they dip into the convenient well of stereotypes or, as in the case of Canada’s Ersatz George Will or Roy MacGregor they just resort to old-fashioned safari journalism. It all comes out to the same malodorous end. There may not be a bubble in St. John’s harbour any more but you can get the same effect by reading anything in the Globe about events east of Oshawa.

You can tell the whole notion of a “Danny Williams Effect” was just so much bullshit because you don’t hear these people talking about it any more. Well that and the fact no one decided to call a band after him.

Alan Parsons Project.

Danny Williams Effect.

Anyway…

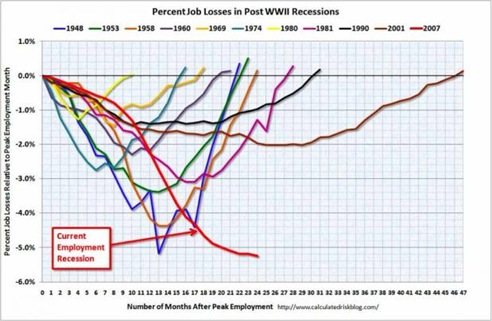

The recession put paid to any idea of an economic protective shield or immunity derived from The Will of I Am.

The recession also should make it plain that the financial boom of the last couple of years had nothing to do with projects that don’t exist – like Hebron for the house brokers – or with endless jihads against foreign infidels.

Nope.

It was all about outrageous oil prices.

And when those outrageous oil prices stopped, so too did the miracle.

There were a couple of new bits of evidence this past week that the whole economic DW effect was fiction. That is, if Paul Oram’s confession wasn’t enough, already.

Shell found out it couldn’t offload a refinery in Quebec. No one was interested in taking a refinery and reworking it to feed the North American energy market. Reworking is cheaper after all than building new. Just ask the guys behind that second refinery fairy tale on a day when they aren’t trying to lure new investors. They’ll eventually tell you what the market has really told them all along. Hint: it ain’t anything close to “here’s a cheque and when can you start building.”

Then there was a piece in the Globe that noted Ontario electricity prices are the lowest they’ve been in years. Consumers aren’t getting the benefit of the low prices – three and a half cents a kilowatt hour – because the province is using the cash to subsidize a raft of expensive “green” projects like wind farms.

That should pretty much tell you why it is that there is nothing called the Danny Williams Effect that has yet to produce The Best Undeveloped Green Energy Project in North America.

Nor is there some conspiracy in Quebec acting like some sort of French Canadian kryptonite to block the Great Effect from, well, having an effect, great or otherwise.

Rather, it is simple economics.

As myths go, the Danny Williams Effect was a strong one.

But as a myth that seems to have been about the only power it really had.

All you have to do is look at the evidence.

-srbp-