Wade Locke and Don Mills are two of the faces most associated with the current Conservative administration in Newfoundland and Labrador, aside from the politicians, that is.

Mills played a key role in Danny Williams administration. Mills polling firm provided government with quarterly surveys. Williams also tried to manipulate Mills’ survey results for questions on local politics that Mills used to market his research company.

The quarterly polling was key to Williams efforts to silence dissent and maximize his own freedom of political action. The more popular Williams became, the less likely were any opposition politicians or news media to question his decisions.

And for everyone else, the Conservative message was that any dissidents were out of step with the majority of Newfoundlanders and Labradorians. Mills’ polling purportedly showed that Williams and his party were popular to an unheard of degree. “He’s right because he’s popular and he’s popular because he is right,” was a common Conservative talking point.

That’s why it has been so interesting the past few months that Mills has been criticising the provincial Conservatives in Newfoundland and Labrador.

Mills did it again last week. He spoke to a meeting of the St. John’s Board of Trade about politics and the economy throughout the Atlantic provinces.

We don’t have a text of the speech but we do have media reports. They all picked up on this bit, as quoted here from the Telegram account. Let’s take it as the key message of Mills’ speech:

“We’ve conditioned people to believe … you have the right to live anywhere you want in Atlantic Canada and have the same level of government services as everyone else has, and the same economic opportunities, or be subsidized in that choice,” Mills said in an interview after his speech. “That attitude is really what’s preventing people from thinking about being able to commute for jobs or public services any reasonable distance.”

In a scrum with reporters, Mills also said that politicians cannot deal with public expectations because they are too focused on getting elected. They tend to pander, in other words. [CBC story and scrum video]

"The downside of Danny Williams, and I have a lot of respect for him, is that he doubled the provincial budget within that timeframe too," said Mills [CBC online story linked above].

"He left the province with a structural budget problem that is going to be difficult to fix."

The Telegram also reported that Mills questioned attitudes in this province about immigration. According to “Mills’ survey data, 60 per cent of of Newfoundlanders and Labradorians think the province is as diverse as the rest of Canada, even though that’s plainly not the case.”

“Most people also support either the same levels of immigration, or less, “ the Telegram story said, “despite the fact that the population is shrinking, and that doesn’t do anything good for the economy.”

CBC’s Peter Cowan added some additional points from Mills’ speech in an interesting commentary on how economic problems are hurting the provincial Conservatives. Cowan said Mills noted that:

- “our gross domestic product is actually smaller today than it was seven years ago. “

- “New housing starts are down,

- “car sales are down,…”

- “sleepy old Prince Edward Island is actually growing its economy a lot faster than we are,” and

- “Even with Muskrat Falls, Hebron and Long Harbour construction, he says our economy hasn't grown in the last seven years.”

The Irate Astigmatic Seer

Mills’ comments got some media attention but that’s nothing compared to the attention they got from Memorial University economist Wade Locke. Mills’ comments enraged Locke to the point that he dashed off 25 slides and blasted them out to news media as some sort of rebuttal to Mills’ presentation.

Friday morning Locke appeared on CBC’s East Coast morning show to talk about his slides. He was obviously upset. Locke usually only gets upset when someone criticises his own handiwork.

That’s a crucial thing to note here. Locke’s slides are not the work of an impartial observer. They are not the work of some expert called in routinely by governments of all stripes to help them out. He has a very deep attachment to the current Conservative administration and their economic policies.

Locke has been connected to the provincial Conservatives since he endorsed Danny Williams election platform in 2003. He is regularly featured as a commentator on government policy. His role in developing those policies, like Muskrat Falls, is seldom acknowledged.

That doesn’t mean Locke is right or wrong. What it does explain though is why Locke got into the discussion in the first place. It also explains why Locke avoids entirely Mills’ core point. Mills talked about public beliefs and attitudes about the state of the economy. Locke doesn’t deal with that issue at all. Nor does Locke deal with Mills’ observations about immigration.

It’s all about the oil, ‘bout the oil, ‘bout the oil

Instead, Locke pushed out a hastily cobbled-together set of slides solely for the purpose of arguing about the state of the provincial economy. It’s the same as his advice to the Conservatives a couple of years ago. The future is bright. Don’t be afraid to spend tons, even if you have to borrow. We might have to make some minor, unspecified adjustments along the way.

Oil will be back.

Locke actually says that flatly.

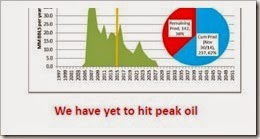

Slide five, at the bottom, in red so you can’t miss it.

Unfortunately for Locke, his very next slide shows we have hit peak oil already. What is coming will be another peak that is short-lived. Production will decline almost immediately, according to the government’s own forecast. While production will carry on at quite sizeable levels for about 10 or 15 years, fields that are currently in production – like Terra Nova – will dry up in the meantime.

What Wade has to rely on to bolster his fundamental argument – oil WILL be back, dammit – is nothing more than conjecture.

If other projects come on stream (like Bay du Nord), NL can expect production to be at or above current level for the next 15 to 20 years, at least.

That is an awfully big “if” about Bay du Nord and other, unknown discoveries. Bay du Nord is well offshore, in very deep water, and the company behind the project doesn’t know whether or not they can develop the project successfully yet. They may not know for a number of years more. If the past is any guide, they won’t know before the end of this decade.

That means that development and production won’t begin until closer to the end of the next decade. And that means that Locke’s bold claim about more projects is about as reliable as his aluminum smelter prediction a few years ago.

Oil Prices

Even if Wade’s overly optimistic projection about oil production turned out to be true, there is still the niggling question of oil prices. When prices plummeted last year, Locke honestly told the world he had not seen it coming.

That’s a pretty significant failure given that in this set of slides, Locke unequivocally states that oil prices will very shortly be back in the range needed to meet his forecast. “Oil prices are increasing currently,” Locke wrote at the bottom of slide 6, “and are expected to pick up further in the near future.”

Whenever you see that passive sentence construction - “are expected” - the hairs on the back of your neck should stand up. The sentence doesn’t identify who is doing the expecting. In this instance, that vagueness is likely because Locke is aware that there is no clear consensus about what oil prices will do. There is less fact in Locke’s slides and more opinion than Locke seems willing to acknowledge.

The Net Debt Fallacy

There are also some genuinely bizarre comments. Take the section on debt as a good example.

“Debt servicing costs have fallen in line with reductions in net debt.”

That’s not true.

Debt servicing is the money it takes to pay the interest on public debt. That cost doesn’t depend on something called “net debt”. How much the government pays in interest on public debt is affected by how much the government owes and the rate of interest on each loan or bond over the period the government has agreed it will take to pay back the money.

Net debt is nothing more than an accountant’s calculation that takes all that you are liable to have to pay someone and subtracts any assets that you have that you could use to pay off those liabilities. That’s all it is.

If you have a mortgage for $1.0 million and you have assets like the home valued at $1.0 million, your net debt is zero.What you pay the bank on the mortgage isn’t zero. If you add more debt and add more assets such that your net debt is zero, you still don’t pay zero. If you pay down half your mortgage, the bank doesn’t suddenly owe you money even though your net debt is now far less than zero. You will pay what the mortgage says you have to pay in order to cover the $1.0 million plus the interest over the period you borrowed the money.

The Conservatives have talked about net debt because it is a common calculation used by accountants including the auditor general. The Conservatives really like it because it makes it look like they have reduced public debt.

They haven’t.

The public debt reported in The Estimates in 2003 was about $8.0 billion. In 2015, the debt will be about $12.0 billion. The cost of servicing the debt remains only slightly above where it was more than it did a decade ago. That’s because the government has converted debt at a higher interest to debt at a lower interest rate when the high-interest loans came due. They’ve been doing it for decades.

Locke typically downplays any talk of debt. He doesn’t seem to mind when government accumulates it. His flawed commentary on Muskrat Falls – he left out crucial details that didn’t help the sales pitch for it – simply stated that taxpayers could absorb an $800 million tax on the local economy without any impact. It isn’t clear that Locke actually assed the implications of such a tax on the economy, given the other assumptions of the Muskrat Falls model.

More recently, Locke has cavalierly accepted the notion of adding enormous levels of new public debt. The most he has offered is that if we “If do not control debt, we may get back to 1-in-5 or 1-in-4 dollars of provincial revenue being diverted to debt serving (forecast to go from 11.6% 2014-15 to 12.7% in 2015-16).”

At best that’s a penetrating insight into the obvious. What’s more revealing, though, is that Locke didn’t include an actual assessment of current government plans for new debt using a range of assumptions about government revenue. Had he done so, Locke would have realised that a few modest changes in the assumptions used to develop the current budget would push public debt into those problem ranges.

Drop the assumed price of oil, for example. On top of that, assume that the future administration – regardless of stripe - won’t have the political will to cut spending such that it has to borrow more money than the current planned amount. On top of that throw an expensive electricity subsidy program to help offset electricity prices thanks to the high rates needed for Muskrat Falls.

Current government revenue is $5.7 billion. Let’s give the government revenue of an even $6.0 billion in 2021. The debt servicing cost in that scenario above could wind up being about $1.5 billion, instead of the $1.0 billion currently forecast. There’s Wade’s magic “1-in-4.”

The current estimate would put it at one-in-six, incidentally, if you assumed the situation five years out will look more like the one this year than the one forecast. Before you dismiss the notion, just bear in mind that when it comes to forecasting, you are a prisoner of your assumptions.

Ultimately, Locke’s slides actually lend more weight to Mills’ contention that the provincial economy is not as healthy as people assume. That’s because a huge part of Locke’s slide show plays up the role that oil and mining have in the economy. Locke even plays down the size of the public debt by using slides that show the debt as a share of an economy dominated by high oil prices.

Locke is right on that point. The economy is driven by oil. It’s also true that the government has boosted spending based on commodity prices that are prone to unpredictable and dramatic changes. And it is also true that government spending plays an unhealthy role in the economy these days. Locke himself has acknowledged that – indirectly – in the past by noting that cuts to government spending would adversely affect the provincial economy.

If Locke wasn’t so intimately connected to the provincial government’s financial problems he might have been able to take an objective, analytical approach to the comments Don Mills offered last week.

Then again, if Mills was actually from here, that might not have caused Locke such a problem either. In his interview on Friday morning, one of Locke’s repeated points was that the problems facing Newfoundland and Labrador were not ones for foreigners to address. The fact Mills is from Nova Scotia seemed to bother Locke more than anything else.

Apparently, that’s what Wade meant when he wrote in his slides that “Newfoundlanders and Labradorians need to have a discussion about services that we want and are prepared to pay for (that is, we need a discussion of what defines us as a social entity).”

We aren’t really talking about economics and public policy. We are discussing ethnic identity politics. Who would have guessed?

-srbp-