The provincial government hasn’t really been managing the public purse in a sustainable and fiscally responsible way.

Your humble e-scribbler has been saying that since 2006. There have been plenty of charts and graphs to drive the point home.

In 2009, Paul Oram said that government spending is unsustainable, but unfortunately he said it on the way out the door as he left politics.

But you don’t have to just accept that just because you read it here.

Now you know that government spending is unsustainable because no less an authority than Tom Marshall – the province’s finance minister – is saying that in every single one of his pre-budget consultations.

Take a look at the slide deck for his presentation. You’ve seen similar slides here and in some of the conventional media maybe. You’ll find the information is a wee bit familiar and that’s because the figures your humble e-scribbler uses and the ones Tom is using come from the same place: the provincial finance department.

But Tom’s slides are better because they are accurate and up-to-date. Now Tom doesn’t give you all the information you’d but what is there is enough to scare the bee-jeebers out of any doubters out there.

Before we get into the details, let’s just say that True Tory Believers should turn away and go play Free Cell or something. They really should not read on. Fan Clubbers should really not read beyond this point. They are putting their heads in jeopardy. Their whole world only keeps making sense because they have convinced themselves that nothing at BP is real, that it is all wrong and just some sort of partisan plot.

So if they keep reading to the end, your humble e-scribbler cannot be held liable for the resulting carnage as their skulls collapse. After all, if your faithful servant says these things only because he is a Liberal and then Tom Marshall says the same things then either Tom is telling whoppers or I am a Tory or…

You can see how easily they could wind up in the Waterford trying to make those two things fit into the same twisted mental space.

Anyway, here goes.

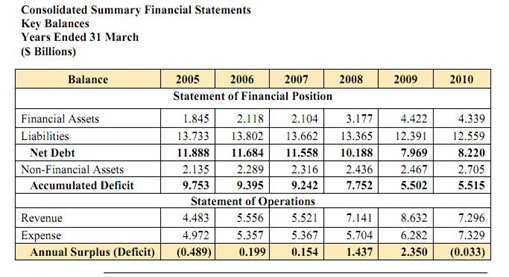

This slide from near the end of Marshall’s presentation shows the net program expenses – everything except debt servicing and capital costs – compared with the consumer price index and the growth in the economy. This is a really good comparison because it shows the changes in the core government spending without things like the “stimulus” capital spending.

This is the sort of spending that would be very hard to cut if revenue dropped drastically. And you can really see the point if you recall that so much of the economy – 30% or so of the labour force – is paid out of net program expenses. This is your health care spending as well.

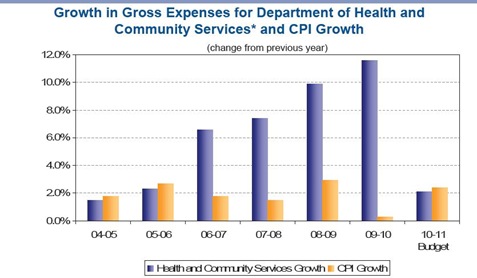

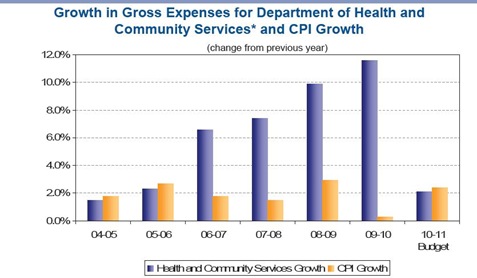

Now just because Tom Marshall used it, let’s look at the slide showing the comparison between the growth in gross health care spending – with capital works tossed in – and the consumer price index. This slide together with the one above illustrates the astronomic growth in spending over the past four years.

This slide also shows you a comparison which pretty much destroys any argument that the rate of gro9wth was the only thing Tom and his friends could have done. You’ve heard all the excuses about catch-up and making up for previous neglect or that costs are just going up because things are booming.

Don’t look at 2009-2010 because that’s the recession year when the costs of goods and services didn’t grow very much at all. Look at the two years before that. The provincial government could have boosted spending by double the rate of inflation and they still would have boosted spending by a huge amount. Instead, they went for triple or more. in 2007, the year of the last election, they boosted spending by what looks like six or seven times the rate of inflation.

And all that spending was built on what Tom Marshall acknowledges are windfalls from the price of oil. They are windfalls driven by price and by production of a non-renewable resource. All wonderful to spend and spend more as long as the cash is rolling in. But when the prices don’t keep skyrocketing and the money isn;t flowing in, you have a hard time driving spending up at the rate people want.

That’s the definition of unsustainable spending.

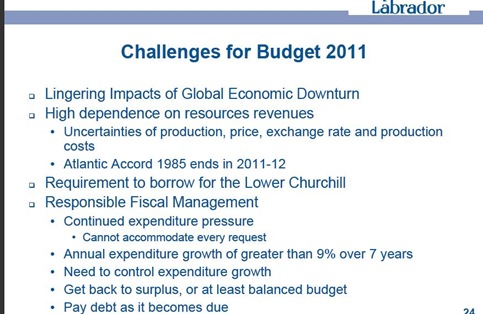

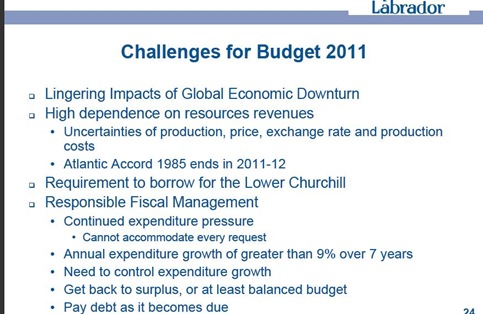

Not surprisingly, you can see all the problems in the final slide Marshall used in which he laid out his “challenges”.

That second bullet, the one about high dependence on resource revenues is the bit about price and production. Great going up but prices do go down.

Skip down a bit and you’ll see the other point: there’s pressure to continue spending increases and people are used to seeing growth of nine percent on average over the past seven years. Inflation averaged around two percent each year or thereabouts over the same period.

All the stuff that comes before this points to that bullet about the “Need to control expenditure growth”. Problem is that expectations are there for continued growth and those expectations are on top of the real need that comes from having an aging population and that is on top of the commitments to boost public spending on megaprojects like “equity” stakes.

If that weren’t bad enough the combination of election year plus the unsettled Conservative leadership combine to make it very difficult for politicians to make the tough choices and actually control spending.

Remember 2007?

If you’ve forgotten already, scroll back up and look.

A very popular leader with a reputation for toughness and they still couldn’t spend in a responsible, prudent manner.

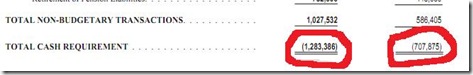

And if all that weren’t enough to make you cringe, take a look at that last point. There you have the provincial government’s great plan to reduce public debt: they will pay it off as it comes due. That means about $200 to $300 million a year.

Divide that into the $12 billion gross debt and you can figure out how many decades will take - theoretically - to get to zero at that rate. Yeah don’t bother. Let’s just sum it up by saying the current administration does not have a debt reduction plan at all. Not really. They don’t. If things get really bad, they can just roll debt over and that’s what governments have done over the past couple of decades. They could pay off some debt as it came due; otherwise they just spent as they needed and ran up the debt bill.

We aren’t done yet, though.

That middle bullet about a “requirement” to borrow to pay for the Lower Churchill.

It is only a requirement because the provincial government already made the decision to add another $4.0 to $6.0 billion to the public debt. They don’t absolutely have to do it and, frankly, the deal as laid out currently is one that doesn’t make any sense. It would be a huge risk for any government or private sector company that had a healthy balance sheet. Even with a federal loan guarantee, it is sheer foolishness for the province with the biggest per capita debt load in the country.

Upside: admitting there’s a problem could mean that Tom Marshall and his colleagues will start sorting out the mess they’ve made.

Downside: Tom’s admitted to some or all of this in the past in the pre-budget consultations only to bring down a budget each time that did exactly the opposite of what was needed to fix the problems. Only Danny’s gone: the rest of the people responsible for seven years of unsustainable public spending and unsound management of the public purse are still in charge.

We can hope for the best but experience tells us all to expect the worst.

- srbp -

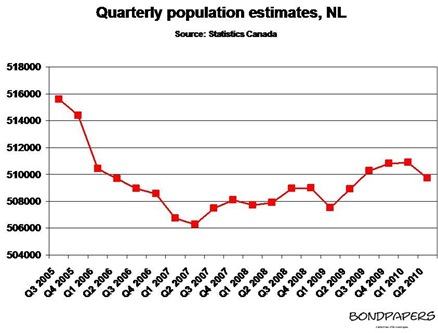

This is not a subject the Fan Clubbers like to talk about but it is real. it also just happens to be one of the major financial problems facing the province that isn’t being addressed by the current administration.

This is not a subject the Fan Clubbers like to talk about but it is real. it also just happens to be one of the major financial problems facing the province that isn’t being addressed by the current administration.