[Note: This was originally written on Saturday night and time-delayed until Sunday morning. However, as events overnight changed the story, here it is with a new post to update is on the way.]

______________________________________________

The poll goosing army got its act together.

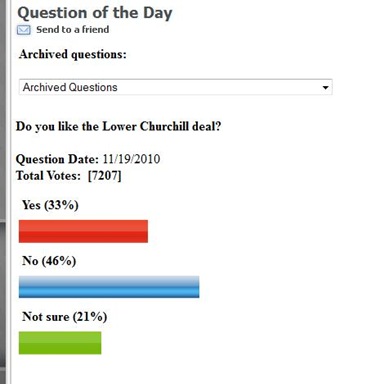

A little over 12 hours after your humble e-scribbler pointed out that the Old Man’s retirement scheme wasn’t polling too well at voice of the cabinet minister, things changed.

From a little over 7200 votes on Saturday morning there were an astonishing 25,413 votes later on. Suddenly 70% of the universe is loving the retirement idea.

Here’s what the results were at about 10:30 Saturday morning:

![qotd20nov1030[4] qotd20nov1030[4]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhb0B8iF7Pxt3WsO8WQCbXzqmj7ofXtrlVxUl-RGU0mks9wnwjFfMauHJI_VcGurND0w7JToOLq_B1Dpc8PHlSNsNbpsq5CMvo3Pit7fm4pnj2IDDUc4SZNLyXQ2KN-FaLZAvAyJA/?imgmax=800)

This is a just a reminder that someone in the province’s reform-based Conservative Party pays way to much attention to this sort of trivial stuff.

No one has documented the whole foolish business as consistently as labradore. In January 2008, for example, labradore noted the gigantic number of votes on question of the day polls that were important to the Premier (or mentioned him by name) versus some other topics.

In October 2009, he noted the same trend with the new VOCM website even though some technical changes made it harder for some dork to sit at a computer and mouse click his way to premature carpal tunnel all to make the Old Man look better.

Now that one is interesting because it makes it pretty clear that the vote total earlier on Saturday was actually higher than the average already. The late night total was more in line with the ludicrous numbers from the old-style VOCM website.

Meeker on Media has also done a few posts on it. One titled “Vote fixing” appeared in 2008. It’s been re-dated as a result of the recent switch to a new layout at the Telegram website.

After Meeker blogged about one technique for rigging the poll, someone must have tried it. The resulting click duel wound up crashing the VOCM poll system. Meeker’s comments at the time are worth repeating because they show a similar pattern of insane click counts as we’ve seen so far on November 20:

I saw some irony in the question. I also noticed that, at the time (about 12:30 pm), there were almost 2,000 votes at the site, with 63 per cent disagreeing.

My prediction was that, if the Yes votes made a sudden resurgence, the Trained Monkeys would immediately start clicking No and the voting numbers would go into the tens of thousands (they usually like to maintain a 70 per cent share of the vote).

And my prediction was correct. People did want to play this game. Within an hour, the number of votes had doubled, and the Yes side was out in front. At 2:30 pm, I had to go to a meeting, and at that point the Yes side was still leading, with 55 per cent of 10,000 votes cast.

That's right, ten thousand! It was wild.

When I got home later in the evening, the No side was winning. Votes at that point were around 25,000, and they were back around 60 per cent.

While I was talking live on the radio with Linda Swain, the number of votes was actually increasing by the thousand, as the minutes went by. The last tally I saw was 53,000 votes, with No holding at about 60 per cent.

This poll question will be up all weekend. It’s going to be fun watching to see what happens by Monday morning when the VOCM will likely change the question.

In the meantime, as you look at this an laugh, just recall that someone has obviously been organizing this intense idiocy for the past seven years.

And then Danny Williams complains about what he could get done if he wasn’t distracted. Well some of us have been saying that for years.

When this sort of foolishness turns up again, you have to wonder how much could have been accomplished if all the rest of his Fan Club actually did real work instead of obsessing with this sort of trivia to the point they spend an unhealthy chunk of a November Saturday making sure VOCM news told the right story in its QOTD report on Monday

Incidentally, just for fun watch and see if the comments section of this post starts turning into a laundry basket full of Conservative sock puppets (right, not exactly as illustrated).

Incidentally, just for fun watch and see if the comments section of this post starts turning into a laundry basket full of Conservative sock puppets (right, not exactly as illustrated).

Odds are good it will happen just like they all turned up on the earlier one about poll goosing.

- srbp -

![qotd20nov1030[4] qotd20nov1030[4]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhb0B8iF7Pxt3WsO8WQCbXzqmj7ofXtrlVxUl-RGU0mks9wnwjFfMauHJI_VcGurND0w7JToOLq_B1Dpc8PHlSNsNbpsq5CMvo3Pit7fm4pnj2IDDUc4SZNLyXQ2KN-FaLZAvAyJA/?imgmax=800)