If it wasn’t for oil prices, the provincial Conservatives wouldn’t have anything to crow about when it comes to public finances.

And since they have no control over the price of oil, you don’t need to be a rocket scientist to understand that building their budget plans on oil prices is something bordering on insane.

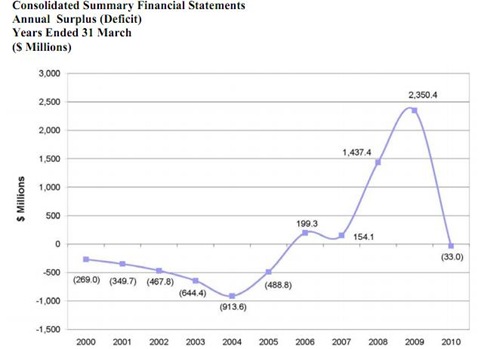

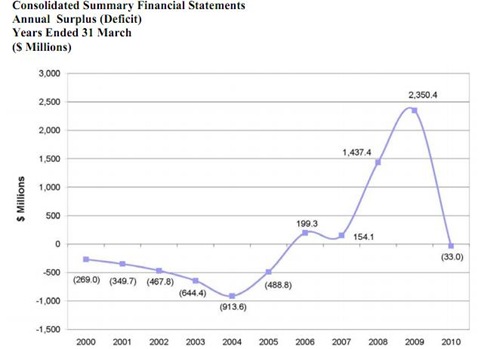

You can see that insanity by looking at a chart from the Auditor General’s recent report showing the provincial government’s budget surpluses and deficits.

Three things:

- Remember the fiscal year numbering thing – The AG misreports the year. To find the actual fiscal year, knock one off. In other words what the AG calls 2010 is actually 2009.

- These are accrual or accounting surpluses. If you look at the actual cash performance, there are some chunky deficits in these years. Like 2009 for example when the provincial government had to take about half a billion from its cash reserves to cover that whopper of a deficit. Ye olde e-scribe wrote about this before - in 2008 - along with a couple of lovely pictures to illustrate the point.

- Those gigantic surpluses in the chart weren’t planned. In fact, if they planned anything, the current provincial government crowd planned on going in the hole. They came out in the black because oil went to insane prices. Look at the budgets for those years and you will see that Tom Marshall and his colleagues planned gigantic spending deficits.

Take 2007, for example. According to the budget for that year, Tom Marshall planned to come up short by $1.2 billion. The year before he actually came up short on cash by $707 million.

While you’re at it, these charts also explode the latest bullshit bomb finance minister Tom Marshall’s been spreading now that the Auditor general’s report is on the street. According to Tom there was a plan, tons of fiscal responsibility and then temporary deficits to make sure the nasty old recession stayed away from our shores.

If you reflect on the actual budget history of the Williams administration, you will see that only real difference between 2009 and all the years before isn’t that 2009 was a year of “stimulus”. It actually follows the established pattern of planned overspending.

What changed was the world price of oil. In 2009, the provincial government’s budget forecast and the actual average turned out to be pretty much the same number. 2010 might not be far off that experience, at least as far as cash flow goes.

And that “stimulus” spending? Well about half of it was actually stuff the provincial government just couldn’t deliver two or three years before when they first promised it. The packaged it up and called it “stimulus” but it as really something a lot less impressive than it sounded. It was, however, a typical Fernando announcement: it looked a lot better than it actually was.

The provincial government has spent the last seven years spending public money.

Lots of it.

At umpteen times the rate of inflation.

And they started unsustainable spending long before the world went into a recession.

If they had a plan, it certainly wasn’t to spend responsibly, reduce the public debt and generally look after things for future generations. In fact, if you look at how much they spent and what they spent it on, it looks like old-fashioned pork-barrelling on steroids.

All that puts the current provincial administration is an especially hard spot. Politically, they won’t be able to start fixing the problems they’ve created. There’s the election and then, if they win in October, they’ll have to settle the leadership thing. They can really only carry on with the spendthrift ways they’ve followed for the past seven years.

At the same time, politically, the public is now clued in to the problem, wise to the government torque and looking for the sort of serious leadership decisions that the Conservatives can’t really deliver.

Not exactly the greatest situation to be in with an election coming in a few months time, is it?

- srbp -