No doubt, you remember the

debt clock.

That was the little theatrical device finance minister Tom Marshall used during his trip around the province in what was euphemistically called a pre-budget "consultation". Of course, it was pretty funny to call it a consultation considering that, as the Premier later admitted, budget decisions were already made or were being made as the finance minister attended the meetings.

The debt clock garnered so much attention it became the media story of the entire

affair. And

that, as

Bond Papers noted, was the point of the exercise in the first place.

One would expect that consultations are supposed to be an exercise in soliciting opinions and ideas. They are supposed to be about

receiving messages.

In government practice not just in this province but across the country, "consultations" have become more about government delivering a message to the people who show up for them and the reporters who get assigned to cover them rather than ministers collecting information.

It's fairly advanced doublespeak.

Kind of like delivering a speech and then referring to the oration as an exercise in hearing: "Joe Smallwood," the history professor noted, "was a masterful listener. He sometimes listened to an audience for over two hours describing the economic accomplishments of Smallwood's government."

"Smallwood once said that he would single out the dimmest pair of eyes in a crowd. He would then focus his listening until he saw that the brain behind those eyes understood what Smallwood was listening. At that point, Smallwood could be sure the whole audience understood what Smallwood was hearing."

In any event, if we took the debt clock and the government pronouncements at face value, dealing with the public debt would be a major feature of government policy.

Take a closer look at the 2008 budget estimates, though, and you'll see a different story.

Right off the bat, the

Estimates show a projected increase in total public sector debt in Fiscal Year 2008.

That's right.

An

increase.

Not a decrease, which is what you would expect given the peril of public debt supposedly demonstrated by the debt clock.

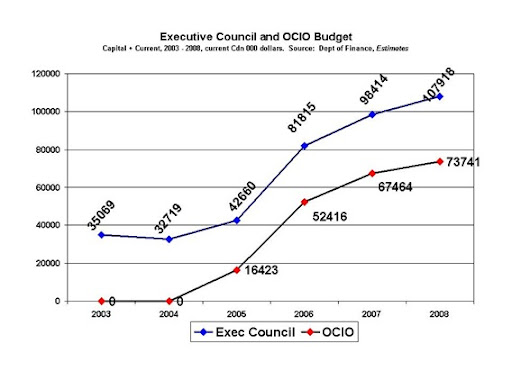

In fact, that would be the third such increase since 2004. Take a look at the table below and you can see exactly what the debt load has been and is. The figures come from Appendix III on page 243 of the

Estimates link above.

Debt, in this case, is exactly what most of us think about when we speak of debt: borrowings.

The phrase "total public sector debt" refers to the accumulated borrowings of the provincial government and its agencies. The whole thing is laid out pretty clearly each year in the

Estimates. It was also discussed in a report from the province's

auditor general just before the finance minister introduced the budget in the legislature.

At this point, minds are boggling. Now if you are so confused at this point you are drooling like a spliffed-out Lab, in the words of Steve Macdonald, just grab your

Bond Papers mug and hold it under your chin.

We're not done yet.

There's this idea of a surplus. Now most of us think of a surplus as being money left over after all the bills are paid.

We've been told that that the surplus in 2007 was over $1.0 billion last year. This year, the province's finance minister forecast a surplus of over half a billion this year.

Find those figures in the Estimates.

Go on.

Be brave.

Take a look.

You'll find the answer in Statement I, which is on page iv of the

Estimates if you've got a printed copy

or page seven of the pdf link.

The real picture of government’s surplus or deficit is found in the estimates in a table called the summary of borrowing requirements.

You can find it usually in the first two or three pages of every budget. That table brings together all government revenue estimates and the spending plans and adds in the debt-related spending to give a total picture of how much money will be left over at the end of the year – a surplus – or how much has to be borrowed – a deficit.

If you go back and take that same statement from each set of

Estimates, you'd wind up with a chart like this one:

Now there is a surplus on current and capital account of a slightly more than $1.0 billion for 2007. Then there's an interesting adjustment. You have to subtract the $305 million in money from the 2005 offshore deal because it was already received. That money shows up in another spot as revenue, but that's just for the accounting of the cash on the province's books. In order to get the accurate picture of revenues, you have to take that amount away.

Then you are left with about the true picture of $737 million, which is still a tidy sum. The only problem is all the financial transactions for the year aren't done. After repaying Equalization overpayments and a federal loan, retiring a bit of debt, putting some cash against the pension liabilities and contributing to sinking funds (to help pay off loans when they come due), the provincial treasury came up $88 million short.

Not a surplus.

A

deficit of $88 million.

And if you take your eyes from the right hand side of that page and switch it to the left hand you'll see the estimated financial state for 2008.

Current and capital account will be in deficit by $54 million. After you take away the advance cash from 2005, the Estimates project a deficit of $414 million.

Not a surplus.

A

deficit.

Carry on with all those other projected financial transactions and the provincial budget shows anticipated borrowings of almost $800 million in FY 2008 in order to balance the books.

In order to produce a surplus of the size predicted - but predicted only in political statements - oil prices would have to continue at double the figure of $87 a barrel used to come up with the budget. So far, it looks pretty good for oil to be somewhere over $130 on through the end of this year, but you never know what will happen with oil prices, especially after the American elections in November and the new president is sworn in late in January 2009.

The provincial government might wind up being right. The US Energy Information Agency predicted in early April this year that West Texas Intermediate will average US$101 a barrel in 2008 and about $10 lower in 2009.

If that forecast holds true, the provincial government won’t have to borrow quite as much as projected or it might not have to borrow very much at all.

Now as you finish wiping your chin or reach for another belt of coffee to calm your nevers, don't fret. The provincial treasury isn't about to run dry next month.

Nor is there anything unusual about a government presenting its finances in the best possible light; "best" being defined as fitting its own political interests or outlook. Governments of all political stripes here and elsewhere in Canada have been doing it for decades to one degree or another and in one way or another. Criticizing them for it is like slagging a dog for barking.

The full picture is usually there in the budget documents.

You just have to look to find it.

-srbp-