Introduced in 1995, the Economic Diversification and Growth Enterprises program – known as EDGE – is the most successful economic development program currently offered by the provincial government.

According to an article in the March 20 issue of the Telegram,

The province estimates that EDGE has created 1,500-1,600 jobs over the years. The government has forked out $17 million in rebates to employers under the program. Those rebates are linked to things like provincial income tax, payroll tax and corporate income tax.

Roughly 40 municipal governments also signed on to the EDGE scheme, providing their own tax relief to qualified companies.

Within the past five years alone, 30 companies have applied for support under the program and two thirds were accepted.

Compare that to the hand-out programs introduced under the current administration. Of the $75 million budgeted over the past three years, the programs have only managed to give away $14 million; of that amount $8.0 million went to a company that promised to increase its workforce but in the end cut jobs.

The provincial government is reviewing the EDGE program to see how it can be improved. Currently 69 companies hold EDGE status. A further 54 held the status at one point but no longer qualify.

As the Telegram described the EDGE program:

To be eligible, a company must create and maintain 10 new permanent jobs in Newfoundland and Labrador and make a minimum capital investment of $300,000 or have incremental annual sales of $500,000.

Tax incentives are provided to EDGE-designated companies for a period of 10 or 15 years, followed by a five-year period of partial rebates.

Part of the program’s enduring success is the philosophy behind it. EDGE recognised the changed global economic circumstances and placed its greatest emphasis on encouraging the private sector to develop innovative, globally-competitive industries that could survive without extensive government cash support.

The background to the program is contained in a public consultation paper released in the summer of 1994. The main sections of that document are reproduced below. in light of the current government policy and the review of EDGE, it would be useful if more people in the province were aware of an economic development philosophy that continues to deliver strong results almost two decades after it first appeared.

Excerpts from:

Attracting new business investment: a White Paper on proposed new legislation to promote economic diversification and growth enterprises in the province

(June 1994)

1.0 BACKGROUND

The Strategic Economic Plan for Newfoundland and Labrador, which was released in June of 1992, outlined the economic challenges facing the Province and charted new policy directions to guide economic development over the long term.

The Strategic Economic Plan noted in particular that the globalization of economic activity and the liberalization of world trade presents significant new export opportunities for manufactured goods and commercial services. Technological advances made in transportation and communications over the past decade, combined with the shift towards a more knowledge based world economy, have also reduced the relative importance placed on geographic location for many industries and firms, and this has created further opportunity for the development of new products and services. At the same time, however, these trends have brought increased international competition for economic activity, not only in the development of new products and services, but in respect of many of our existing industries as well.

These profound changes in global trade patterns, investment flows and technology constitute the driving force behind the fundamental economic restructuring that is now occurring in many countries. In an increasingly competitive and knowledge based world economy, it is clear that we can no longer rely on traditional approaches to attract new business investment and expand existing business enterprises. We will, out of necessity, have to become more outward looking in our approach to economic development and create an appropriate investment climate that supports international competitiveness.

It must also be recognized that the private sector is and will continue to be the engine of economic growth. This is a key principle embodied in the Strategic Economic Plan and reflects the reality that the private sector is the most effective vehicle through which lasting economic wealth and employment opportunities can be created for the people of this Province. It is the role of government in this context to create the economic climate in which private sector investment can occur and be successful.

2.0 GOAL

The goal of attracting new business investment as a means to create additional employment opportunity for the people of this Province is not a new concept. Indeed, various governmental incentive programs have met with measured degrees of success over time in this regard. However, the rapidly changing global marketplace and the province-wide impact on the economy resulting from the collapse of the groundfish fishery have heightened the need to significantly improve the attractiveness of the Province to the private sector as a place to invest and prosper. New business investment directed at economic diversification and general economic growth is not only an objective but an imperative at this juncture of the Province's history.

The Government of Newfoundland and Labrador intends to adopt bold and innovative measures to transform the Province into one of the most attractive locations - not only in Canada but in all of North America - for new business investment and to take aggressive new steps to market and promote the Province's strengths in this regard on a national and international basis.

The main elements of this new program will be reflected in legislation to be known as "An Act to Promote Economic Diversification and Growth Enterprises in the Province". This legislation will be presented to the House of Assembly for its consideration in the fall of 1994 and will provide an enhanced "business friendly" regime for new and expanding business enterprises in the Province.

3.0 SCOPE OF PROPOSED LEGISLATION

3.1 Eligibility

New business enterprises wishing to establish in the Province and existing businesses wishing to expand their enterprises will be eligible to receive a range of special business development incentives, provided that certain conditions are met. These will be in addition to any other incentives the enterprise may be eligible for under other assistance programs established to encourage business development in the Province.

To qualify for the special incentives, an enterprise must meet the following tests:

- The proposed new business activity must have the potential to bring substantial new or expanded business investment and employment to the Province. Only those projects involving capital investments of at least $500,000 and having the potential to generate incremental annual sales of $1.0 million, as well as creating and maintaining at least 10 full time permanent jobs in the Province, may apply to Government for access to the special incentives.

- The proposed new business activity must be consistent with the objectives for economic development that are embodied in the Strategic Economic Plan.

- Reasonable assurances must be available to demonstrate that the proposed new business activity, in the absence of the special incentives, would not otherwise be pursued in the Province. This test is intended to ensure that incremental economic activity will be stimulated by the new incentives.

- The proposed new business activity must not be directly competitive with or have an adverse impact on the viability of other businesses already established in the Province. This will ensure that existing business enterprises will not be placed at a competitive disadvantage relative to those companies and investors who are able to take advantage of the new incentives.

- The proposed new business activity must have the potential to generate substantial value-added economic benefit to the Province.

Both new businesses and existing businesses expanding their operations will be eligible for the special incentives. However, in the case of existing businesses, only those elements of a company's operation which are incremental to its existing scale of operation will be eligible for the incentives.

3.2 Review and Approval Process

Companies seeking the special incentives available through the new legislation will be required to provide documentation in the form of a comprehensive business plan to allow for a thorough assessment of its proposal. The specific requirements in this regard will be outlined fully in the legislation.

Particular attention will be given during the review process to the commercial viability of the proposed business activity over the long term. It is not the intent of the legislation to artificially support new industries or new business activity in the Province, but rather to attract and assist in the development of viable and sustainable economic enterprises and employment opportunities for the long term benefit of the people of this Province.

All applications received under the new legislation will be reviewed by a committee of Cabinet Ministers chaired by the Minister of Industry, Trade and Technology, with final decisions on eligibility to be made by Cabinet. Part of the process in making a determination as to whether or not the special incentives will be granted to a company will involve a public notice procedure whereby Government will invite interested parties to make submissions respecting all proposals received. This is intended to ensure that all proposals are available for public scrutiny in respect of their potential competitive impact on existing business enterprises and jobs. Appropriate steps will be taken to protect the proprietary and commercial interests of the company when this public notice procedure is invoked.

While all proposals made to Government under the new legislation will be thoroughly assessed to protect the general public interest, Government is committed to a timely review process such that potential investors are not unduly delayed in the implementation of their business plans. Once the committee of Cabinet Ministers is satisfied that it has all the information it considers necessary to properly evaluate a proposal, a decision will be rendered by Cabinet on acceptance or otherwise of a company's proposal within 60 days.

Successful companies will be expected to enter into a formal contract with Government in which the Province will guarantee the benefits provided in the new legislation and the company will bind itself to implement the business proposal as accepted by Government. Notification will subsequently be given to the House of Assembly of all such contracts entered into, and ongoing monitoring of their terms and conditions will be carried out by senior officials.

3.3 Incentives Available through the Legislation

3.3.1 Taxation Incentives

The private sector is presently faced with a relatively high burden of taxation which impedes new investment and the creation of new employment opportunities in the Province. While a number of significant changes to the existing business tax structure have been made by Government in a number of areas in recent years, the entire taxation regime requires further attention if it is to be used as a means of promoting the Province as a highly competitive location in which to do business. Accordingly, the following taxation incentives are proposed for those companies qualifying for assistance under the new legislation:

(i) A full tax free holiday for ten years in respect of provincial corporate income tax, the health and post-secondary education "payroll" tax, and retail sales tax.

(ii) Further relief in these specific tax areas for an additional five year period on a reduced scale, commencing in the first year at 80% of total taxes payable and declining by a factor of 20% each year thereafter.

Municipalities will also be given the necessary legislative authority to grant full property and business tax exemptions on the same basis as outlined in (i) and (ii) above with a majority vote of the respective municipal council. At present, municipalities do not have the legislative flexibility to offer tax relief to individual companies to the extent contemplated herein.

3.3.2 Productivity Incentive

All new and expanding business enterprises experience a significant "learning curve" during the formative years of their operation. Part of this process inevitably results in a productivity "loss" that is incurred by the company at all levels in the organization.

To offset part of this productivity "cost", the Province will provide financial assistance to new and expanding business enterprises in an amount of $2,000 for each full time job created in the Province during its initial five year operating period where the company employs a resident of the Province to permanently occupy the job from the time of its creation.

Appropriate provisions will be included in the legislation to protect the pubic interest in the event of failure by a company to fulfil the conditions upon which the productivity incentive has been granted.

3.3.3 Labour Relations Incentives

A new approach to labour-management relations is required to attract new investment and stimulate new business enterprises in the Province. Government remains fully committed to ensuring that adequate safeguards are in place to protect the legitimate interests of employees and unions. However, it is in the broader public interest to achieve this objective in a balanced manner that also assures those who wish to make new business investments and provide economic opportunity in the Province have a reasonable prospect of receiving an acceptable level of return on their investment without undue risk from uncertain labour relations conditions.

Pursuant to a commitment made in the Strategic Economic Plan, Government is presently developing a comprehensive consultation document which will address various concerns respecting the general labour relations regime in the Province. While the intent will be to develop consensus on changes necessary to make the general labour climate more favourable for all businesses, Government believes that extraordinary measures are required beyond this if new business enterprises are to be stimulated in the increasingly competitive global economy.

Government's proposal in this regard is to make available different Labour Relations Act provisions to new enterprises wishing to establish in the Province and to do so in a manner that will not affect the application of current labour legislation to existing businesses. As well, any existing business where a bargaining agent has been certified for the employees of that company prior to the time it wishes to expand and take advantage of the special incentives under the new legislation will not be eligible for the labour relations provisions of the legislation. Considerable difficulty from a number of perspectives would be encountered in applying two different labour relations regimes to a single business operation, as one firm could have two separate collective bargaining processes, labour contracts and wage rates applying to employees doing the same kind of work. Accordingly, the labour relations provisions of the new legislation will apply to new business start-ups only.

The main features of the proposed new labour relations provisions are as follows:

a. All collective agreements entered into between a company and the bargaining agent for the employees will remain in force for a period of at least five years, unless the contract entered into between the Province and the company in respect of the business undertaking as a whole expires in a period of less than five years.

b. In circumstances where a company and a bargaining agent engage in collective bargaining but are unable to reach a collective agreement, a special panel consisting of a representative appointed by each of the parties and a chairperson appointed by the Minister of Employment and Labour Relations will establish a collective agreement by addressing those specific matters in dispute at the time the matter is referred to the panel.

c. Where a company and a bargaining agent are unable to conclude a collective agreement and the matters in dispute are referred to a panel, the company will not be permitted to lock-out the employees and the employees will not be permitted to strike.

d. A panel, in concluding a collective agreement, will take into account the following factors:

(i) the overall policy objective of the new legislation which is to create conditions favourable to the establishment of new businesses and the expansion of existing businesses in the Province (this factor will be given paramount consideration by the panel);

(ii) the effect of the agreement on the profitability of the business;

(iii) the terms and conditions of employment of employees in occupations in the same or similar businesses both within and outside the Province, with consideration to be given to geographic, industrial, economic, social and other variations that the panel considers relevant;

(iv) the need to establish terms and conditions of employment that are fair and reasonable in relation to the qualifications required, the work performed, the responsibility assumed and the nature of the service provided; and

(v) the needs of the employer for qualified employees.

e. An agreement concluded by a panel will be binding on all parties.

f. The panel will be required to conclude an agreement no later than 90 days after disputes are referred to it for resolution.

g. Every collective agreement entered into between a bargaining agent and a company, including an agreement concluded by a panel, will contain provisions:

(i) requiring the application of progressive work practices in the work place including the use of composite crews;

(ii) relating to wages and to wage increases of employees during the term of the agreement, but those increases will not be permitted to exceed the percentage rise in the consumer price index as reported by Statistics Canada for that area; and

(iii) respecting the final and binding resolution of disputes without work stoppage.

Notwithstanding the provisions outlined above, where a company and a bargaining agent both agree that it would not be in their collective interest to apply the labour relations provisions of the new legislation in its entirety or in part, then those provisions will not apply to the parties concerned. Similarly, in circumstances where a panel has concluded a collective agreement, the parties concerned may, where they mutually agree, vary any term or condition the panel has applied, provided that such agreement does not offend other applicable provisions of the new labour relations regime.

3.3.4 Access to Crown Land

Crown land that a company may require to implement its business plan as approved by Government will be leased to the company for a nominal sum of $1.00.

3.3.5 Appointment of a Facilitator

Upon the request of a company, Government may appoint a person, either from within or outside of Government, to assist the company in obtaining governmental permits, licenses, options for use of Crown assets, and any other authorizations that the company may be required to obtain in connection with its business. This will expedite the processing of all applications for regulatory approval of the business plan and thereby allow the business plan to be implemented in a timely manner. The responsibility for actual decision-making in these areas will, however, remain with the appropriate regulatory agency.

- srbp -

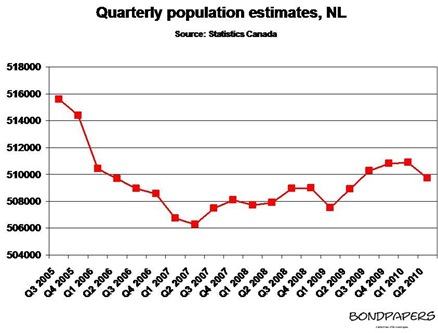

This is not a subject the Fan Clubbers like to talk about but it is real. it also just happens to be one of the major financial problems facing the province that isn’t being addressed by the current administration.

This is not a subject the Fan Clubbers like to talk about but it is real. it also just happens to be one of the major financial problems facing the province that isn’t being addressed by the current administration.