Natural resources minister Kathy Dunderdale is one busy minister these days. She’s turned up in several interviews since the Muskrat Falls announcement to respond to criticise of the announcement coming from Roger Grimes.

As in her interview with CBC Radio’s West Coast Morning Show, Dunderdale dismissed Grimes’ comments. She claimed he didn’t know what he was talking about when he talked about electricity prices going up dramatically if the provincial government’s proposal became a reality. The tone of her voice suggests a certain loathing for the former premier.

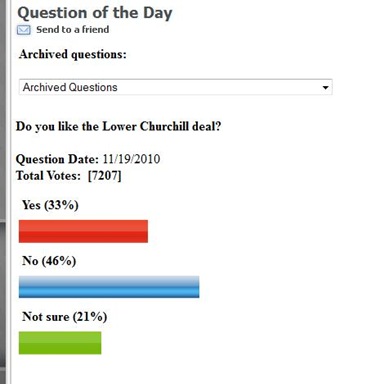

That’s typical of the Danny Williams crowd, by the way. They have a special and personal hatred for Grimes. So intense is the hatred that the Danny fans worked hard to vote in a recent CBC online poll and picked the one option that personally dismissed Roger Grimes as being irrelevant to the discussion just because he is Roger Grimes.

Funny thing, though, is that in every interview Kathy Dunderdale winds up explaining that electricity prices in the province would just about double. In her West Coast Morning Show interview she actually explained things such that you’d believe prices would go up even more than double.

Dunderdale claimed that electricity prices would increase an average of five percent each year from now until 2017. That’s the year Nalcor would supposedly bring Muskrat Falls on line. So electricity prices would be about 35% higher than they are now, according to Dunderdale.

At that point, as Dunderdale notes, Nalcor could start charging for the cost of power coming from Muskrat Falls. She’s already said that Muskrat Falls power would cost between 14.3 and 16.5 cents per kilowatt hour to produce. Add in a rate of return for both Nalcor and the electricity retailer and you are well on your way to electricity prices in the provinces being more than double what they are today.

Double the current price.

Guaranteed.

The provincial government thinks that they can justify their proposal because, as Dunderdale says, they have a projection that oil will be $120 by 2017 and could be as much as $200 a barrel within a decade. So much power on the island currently comes from oil generation that electricity prices will go up because oil will be this and that price along the way. After 2017, Dunderdale says, the increases from Muskrat Falls will be less than what they would be without it, all because of the price of oil.

Well, the truth is that electricity prices could be all those things, but then again, the world of the future could be completely different. That’s because those oil prices aren’t guaranteed. The number the provincial government has from its consultant is a guess. it may be an educated guess but it is still a guess, all the same.

The government’s guess is potentially as reliable as the forecasts in the middle of 2008 that oil would hit $200 a barrel by the end of that year and continue upward thereafter.

We all know what actually happened.

For Dunderdale though – and really for the current provincial government – these numbers are real. Listen to Dunderdale in that interview as she tells the host what oil prices will be next year. She speaks as if it is already 2011 and the prices are known. There’s something vaguely creepy about the way Dunderdale acts as if she and her colleagues can read the future.

It’s right up there with her other unsettling claim. By 2019, claimed Dunderdale, “we will have an energy deficit so we will have to ration energy or we will not be able to provide to ratepayers electricity when they need it.”

Energy rationing.

Maybe blackouts in some areas during the inter months – the peak demand times in this province – because the system can’t handle the demand.

Pretty scary stuff.

That’s the essence of the provincial government’s position: support this or else the place will be a wreck. Maybe super high electricity prices even worse than the super duper prices you are guaranteed to get under our plan for this super duper energy mega project.

Support this plan to jack up the public debt in the province with the horrendously high public debt already because, if not, you know, we’ll have to cut off your granny’s heat for a few hours in the winter time.

Fear.

It’s been a powerful political tool for the current administration, so it’s no surprise they are using it. They’ve thrived on mongering fear of outsiders. During the row last year over the government’s plan to sling power lines through a world heritage site, Danny Williams talked about the costs and possible cuts to health care.

Within the past couple of weeks he’s tossed out the view that the province might be descending into anarchy. Why? Because someone had a strong opinion that didn’t match is or something.

Only a week after the announcement and the provincial government is already resorting to fear as the major way of selling people on a giant electricity price increase and a gigantic hike in the public debt.

No surprise that fear and loathing are core elements of the Williams administration’s political arsenal. it’s just a bit surprising that they’ve turned up [this quickly] as the core of their efforts to convince people to get behind what Danny Williams has described as his crowning political achievement.

Sorta takes the shine off the tiara.

- srbp -

* edited to add words for clarification and to correct typo

![qotd20nov1030[4] qotd20nov1030[4]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhb0B8iF7Pxt3WsO8WQCbXzqmj7ofXtrlVxUl-RGU0mks9wnwjFfMauHJI_VcGurND0w7JToOLq_B1Dpc8PHlSNsNbpsq5CMvo3Pit7fm4pnj2IDDUc4SZNLyXQ2KN-FaLZAvAyJA/?imgmax=800)