Our economic vision for Newfoundland and Labrador is that of an enterprising, educated, distinctive and prosperous people working together to create a competitive economy based on innovation, creativity, productivity and quality.

Strategic Economic Plan, 1992

Our social vision for Newfoundland and Labrador is of a sharing society which balances its economic and social interests, cares for its disadvantaged, nurtures its human and physical environment, celebrates its quality of life and traditional values of individual respect and community responsibility and provides opportunities for personal and collective achievement.

Strategic Social Plan Consultation Paper, 1995

Within a mere two decades, Newfoundland and Labrador transformed almost two centuries of economic backwardness into unprecedented growth.

And yet, as we enter the second decade of the 21st century, a number of factors, some identified in the early 1990s, threaten to rob Newfoundlanders and Labradorians of the bright future they worked to achieve through careful planning, steady work, and a steely determination to endure.

Public sector debt remains at record levels. Rather than reduce debt, the current Conservative administration plans to increase the debt burden still further by building an economically unsound megaproject. What’s more, the most recent economic forecast predicts that the current administration’s policies could triple the debt within a decade. That is on top of the burden from the Muskrat Falls megaproject.

Changes in the province’s population, forecast in the early 1990s, have started to create pressure for new government spending and more government spending. Just paying the interest on the growing debt will rob money that could be helping to pay for those new services.

The highly competitive global economy that has emerged in the past 20 years, coupled with fall-out from the recent recession, will demand even greater inventiveness if businesses in Newfoundland and Labrador will meet the challenges these changes present.

Yet, over the past decade government policy has fostered greater social and business dependence on government hand-outs. The result is a fragile economy that will grow less robust and more susceptible to set-backs.

The answer to these challenges can be found in the principles that lay at the heart of the 1992 Strategic Economic Plan:

- We must foster a change in people. We must renew genuine pride, self-reliance and entrepreneurship. We must once more become outward-looking, enterprising, educated and innovative.

- We must change government. Our people do not need saviours or demigods. They can run their own affairs. We must introduce fundamental democratic reforms. Decisions about education, health and economic development must be made closer to the people directly affected by them. The role of government is to create an environment in which the private sector can develop economically and environmentally sustainable businesses.

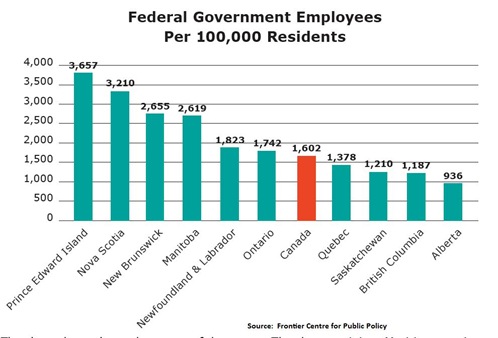

- We must change relationships. We must replace the chaotic, secretive and highly centralised government of the past decade, with mature, professional and open government based on sound long-term planning and a genuine understanding of the province’s long-term interests. Beyond that, we must forge new relationships among governments, business, labour, academia and community groups of the sort envisioned two decades ago. We must build a strong relationship between the federal and provincial governments in order to deliver government services as efficiently and effectively as possible while ensuring that the people who pay for those services can hold the right government to account for what they do.

The ideas that will follow in posts over the coming days and weeks are nothing more than the starting point for discussion.

Only through vigorous, free-wheeling public debate can we build a mutual understanding among all the people of the province on both the necessity of change and of the specific changes themselves.

Change is not a luxury.

Change is not merely possible.

Change is essential.

- srbp -

Next: Building the Fishery of the Future