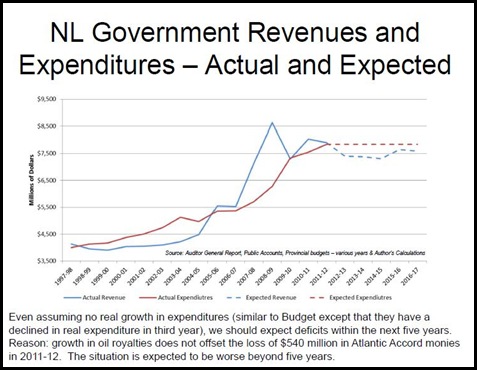

The government’s favourite economist is sounding alarm bells about the provincial government’s financial health. The finance minister, on a local talk radio program, sounding stressed as more and more people start talking about what has been obvious to readers of this corner for some years now: the provincial government is in a financial jam and the current crowd running the place have no idea what to do about it.

Well, if they do have an idea, they have no intention of doing anything, at least within the next four or five years.

Part of the charade they’ve been relying on the past few years is the perception that not only are happy days here but they aren’t ever going to leave. In some years, the finance minister hasn’t been above presenting completely laughable forecasts during the Christmas season to keep consumer spending going through one of the most tax-rich seasons of the year.

Just as the proverbial chickens are coming home to roost in Tom Marshall’s office, it may not be too much longer before a fewer fowl start fouling other bits of the province.

Last week local news media mentioned a report on consumer debt. Newfoundland and Labrador saw the largest jump in the country last year – along with Quebec – at 7.8%. As CBC reported, the average consumer in the province owes $23, 372. That doesn’t include household mortgages.

Flip back to March and you’ll find a red flag on that issue. It was a report by the Bank of Montreal that warned Canada’s housing prices were getting perilously close to a “correction”: especially in places where prices were outstripping incomes or if inflation rates changed rapidly.

Marketwatch.com’s Bill Mann summarised it this way:

The cautionary Bank of Montreal report says average home resale prices compared with personal incomes are 14 per cent above the long-run trend, up from last summer, although still below the 21-per-cent peak that preceded the 1989 crash.

But that is not the case in all Canadian real-estate markets. Five provinces are currently in the danger zone, led by Saskatchewan, where the ratio is 39 per cent above historic norms. That province has a booming commodities industry, centered around potash and oil.

Also well above the long-run levels is Newfoundland, 34 per cent higher; British Columbia and Manitoba, 31 per cent, and Quebec, 23 per cent above.

Overall in the province, debt servicing costs are the lowest in the country according to the most recent report from the Certified General Accountants Association of Canada. But that doesn’t mean there aren’t pockets of risk. The CGAA also reported that incomes in the province fell short of previous growth: problem is the year they are referring to isn’t clear, even though the report was issued in 2010.

Just thinking about it for a second, one could easily imagine there are a couple of potential hot spots in the province. The northeast Avalon and western Labrador are experiencing particularly strong growth and that’s where you’d be more likely to see heavy debt loads and high debt to income ratios.

Not surprisingly, personal debt is one of three issues Bank of Canada deputy governor Jean Boisvin, right, highlighted in a speech in March that Canadians needed to watch as the country emerged from the global recession:

Not surprisingly, personal debt is one of three issues Bank of Canada deputy governor Jean Boisvin, right, highlighted in a speech in March that Canadians needed to watch as the country emerged from the global recession:

Let us start with household debt. Since the beginning of the recovery, household credit has increased at twice the rate of personal disposable income. In the autumn of 2010, Canadian household debt climbed to an unprecedented level of 147 per cent of disposable income (Chart 7).

The relatively healthy financial condition of Canadian households at the beginning of the “Great” Recession helped the Canadian economy to better withstand the initial shocks of the crisis. However, going forward, it is essential to maintain the necessary room to manoeuvre to keep household spending on a viable path. This leads us to believe that the rate of household spending will more closely correspond to future earnings, and certain signs to that effect have already been observed.

Here’s Chart 7 from the speech:

The other two issues were international competitiveness and productivity and investment.

There’s a parallel between the condition of the provincial government’s books and the household accounts in some areas of the province. Just as the provincial government has grown increasing susceptible to small shifts in economic circumstances, so too may more and more households in the province be vulnerable to shifts in the provincial economy.

If the province’s politicians scarcely recognise their own financial problems, it makes you wonder if they might be aware of the issues looming for consumers in the province.

- srbp -